Question: needing help on how to sort this out please!! 12 52 pos 2013020 Financial statements for Franklin Company follow. Ant Current assets Cash Marketable securities

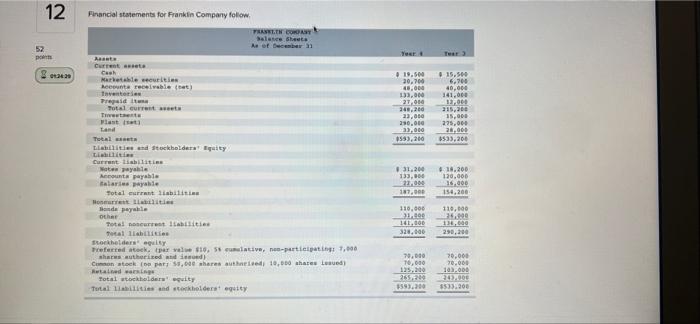

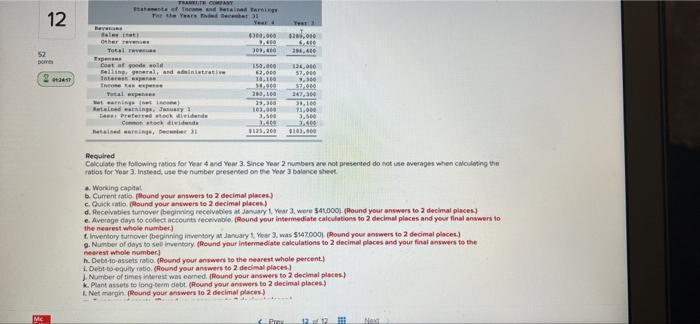

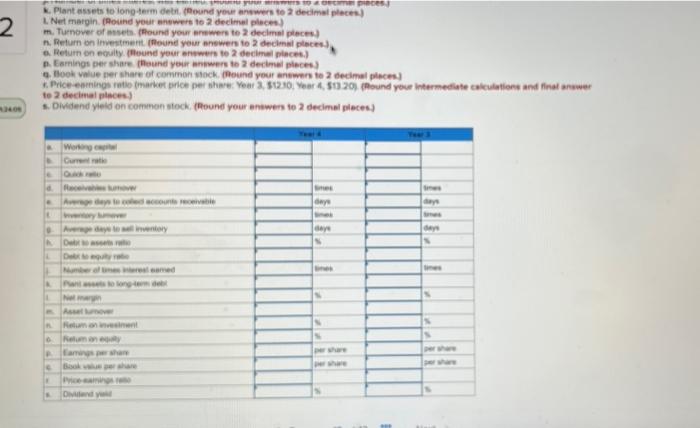

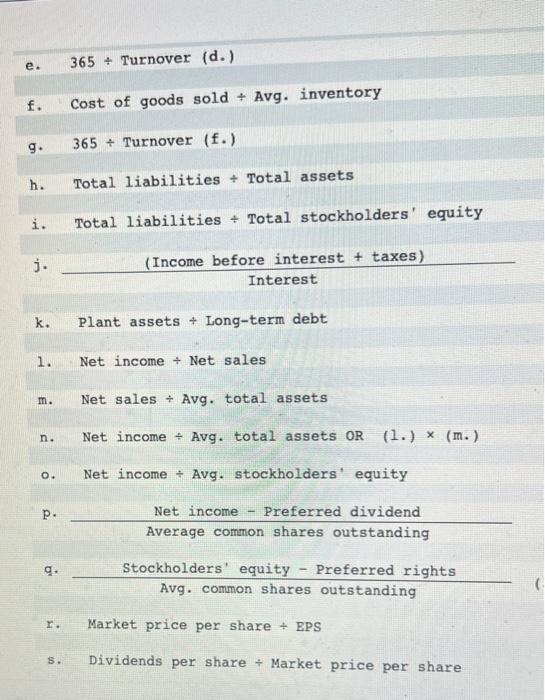

12 52 pos 2013020 Financial statements for Franklin Company follow. Ant Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid t Total current asseta Investments Flat ( Land Total sta Liabilities and Stockholders' Equity Lisbilities Current liabilities Notes payable Accounts payable Salaries payable Total currant liabilities Honearrest Liabilities Honde payable other Total noncurrent liabilities Total liabilities stockholders equity Preferred stock, tpar valse $10, 56 cumulative, non-participating: 7,000 shares authorized and issued) Common stock (op par; 58,000 shares authneised; 10,000 shares Lesued) Retained waking Total stockholders equity Total liabilities and stockholders equity FRANKLIN COMPANY Balance Sheets As of December 31 Your 4 19.500 20,700 40,000 133,000 27,000 240,200 23,000 290,000 33,000 $593,200 #31,200 133,000 22,000 187,000 110,000 31,900 141,000 320,000 70,000 76,000 125.200 265,200 $593,200 Tear 3 $15,500 6,700 40,000 141,000 12,000 215,200 15,000 275,000 28,000 $533,200 418,200 120,000 16,000 154,200 110,000 134,000 134,000 290,200 70,000 70.000 103.000 245,000 $533.200 12 52 Dons 2 ms Mc FRAUETE COMPANY State of Tece and Fetained Tarbinge For the Years Ended caber 31 4300.000 3.400 Year: 2 $20.000 6,400 Total revenus 309,400 294,400 Coat of goods sold 150,000 134,000 62,000 selling, general, and administrative Interest expe 57,000 13,160 3,300 Throne tax expense 58,000 $7,000 Total expenses 200, 100 247,364 et earnings (netice) Retained earnings, January 1 23,300 31,100 103,000 71,000 Less: Preferred stock dividende 3,500 3,500 Common stock dividends 3,409 7,400 Betained earnings, Decuber 31 $125,200 $183,000 Required Calculate the following ratios for Year 4 and Year 3. Since Year 2 numbers are not presented do not use averages when calculating the ratios for Year 3. Instead, use the number presented on the Year 3 balance sheet a. Working capital b. Current ratio (Round your answers to 2 decimal places) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, Year 3, were $41,000) (Round your answers to 2 decimal places) e. Average days to collect accounts receivable. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number) t. Inventory turnover (beginning inventory at January 1, Year 3, was $147,000) (Round your answers to 2 decimal places) 9. Number of days to sell inventory (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number] h. Debt-to-assets ratio. (Round your answers to the nearest whole percent) 1. Debt-to-equity ratio. (Round your answers to 2 decimal places) J. Number of times interest was earned. (Round your answers to 2 decimal places) k. Plant assets to long-term debt. (Round your answers to 2 decimal places) L. Net margin (Round your answers to 2 decimal places) Prev 12 12 Next Bevon al() other revenir Exponans 2 yrs to decum pincess k. Plant assets to long-term debt. (Round your answers to 2 decimal places) L. Net margin. (Round your answers to 2 decimal places) m. Turnover of assets. (Round your answers to 2 decimal places) n. Return on investment. (Round your answers to 2 decimal places), o Return on equity. (Round your answers to 2 decimal places) p. Eamings per share. (Round your answers to 2 decimal places) q. Book value per share of common stock. (Round your answers to 2 decimal places) Price-eamings ratio (market price per share: Year 3, $12.10, Year 4, $13.20) (Round your intermediate calculations and final answer to 2 decimal places) s. Dividend yield on common stock. (Round your answers to 2 decimal places) Working capital Current ratio Receivables over Simes Average days to coled accounts receivable days days inventory Average days Debr eres eamed lines Plant assets to long-term deb Asset lumover % Relum on investment Relum an ey per share Eamings per shar Price-eamings re Dividend yd e d. L A P P A P 4 nek daye N nek N N N per share per share e. f. g. h. i. j. k. 1. m. n. O. P. g. I. S. 365 Turnover (d.) Cost of goods sold + Avg. inventory 365+ Turnover (f.) Total liabilities + Total assets Total liabilities + Total stockholders' equity (Income before interest + taxes) Interest Plant assets + Long-term debt Net income + Net sales Net sales Avg. total assets Net income + Avg. total assets OR (1.) (m.) Net income+ Avg. stockholders' equity Net income Preferred dividend Average common shares outstanding - Stockholders' equity Preferred rights Avg. common shares outstanding Market price per share + EPS Dividends per share+ Market price per share 12 52 pos 2013020 Financial statements for Franklin Company follow. Ant Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid t Total current asseta Investments Flat ( Land Total sta Liabilities and Stockholders' Equity Lisbilities Current liabilities Notes payable Accounts payable Salaries payable Total currant liabilities Honearrest Liabilities Honde payable other Total noncurrent liabilities Total liabilities stockholders equity Preferred stock, tpar valse $10, 56 cumulative, non-participating: 7,000 shares authorized and issued) Common stock (op par; 58,000 shares authneised; 10,000 shares Lesued) Retained waking Total stockholders equity Total liabilities and stockholders equity FRANKLIN COMPANY Balance Sheets As of December 31 Your 4 19.500 20,700 40,000 133,000 27,000 240,200 23,000 290,000 33,000 $593,200 #31,200 133,000 22,000 187,000 110,000 31,900 141,000 320,000 70,000 76,000 125.200 265,200 $593,200 Tear 3 $15,500 6,700 40,000 141,000 12,000 215,200 15,000 275,000 28,000 $533,200 418,200 120,000 16,000 154,200 110,000 134,000 134,000 290,200 70,000 70.000 103.000 245,000 $533.200 12 52 Dons 2 ms Mc FRAUETE COMPANY State of Tece and Fetained Tarbinge For the Years Ended caber 31 4300.000 3.400 Year: 2 $20.000 6,400 Total revenus 309,400 294,400 Coat of goods sold 150,000 134,000 62,000 selling, general, and administrative Interest expe 57,000 13,160 3,300 Throne tax expense 58,000 $7,000 Total expenses 200, 100 247,364 et earnings (netice) Retained earnings, January 1 23,300 31,100 103,000 71,000 Less: Preferred stock dividende 3,500 3,500 Common stock dividends 3,409 7,400 Betained earnings, Decuber 31 $125,200 $183,000 Required Calculate the following ratios for Year 4 and Year 3. Since Year 2 numbers are not presented do not use averages when calculating the ratios for Year 3. Instead, use the number presented on the Year 3 balance sheet a. Working capital b. Current ratio (Round your answers to 2 decimal places) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, Year 3, were $41,000) (Round your answers to 2 decimal places) e. Average days to collect accounts receivable. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number) t. Inventory turnover (beginning inventory at January 1, Year 3, was $147,000) (Round your answers to 2 decimal places) 9. Number of days to sell inventory (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number] h. Debt-to-assets ratio. (Round your answers to the nearest whole percent) 1. Debt-to-equity ratio. (Round your answers to 2 decimal places) J. Number of times interest was earned. (Round your answers to 2 decimal places) k. Plant assets to long-term debt. (Round your answers to 2 decimal places) L. Net margin (Round your answers to 2 decimal places) Prev 12 12 Next Bevon al() other revenir Exponans 2 yrs to decum pincess k. Plant assets to long-term debt. (Round your answers to 2 decimal places) L. Net margin. (Round your answers to 2 decimal places) m. Turnover of assets. (Round your answers to 2 decimal places) n. Return on investment. (Round your answers to 2 decimal places), o Return on equity. (Round your answers to 2 decimal places) p. Eamings per share. (Round your answers to 2 decimal places) q. Book value per share of common stock. (Round your answers to 2 decimal places) Price-eamings ratio (market price per share: Year 3, $12.10, Year 4, $13.20) (Round your intermediate calculations and final answer to 2 decimal places) s. Dividend yield on common stock. (Round your answers to 2 decimal places) Working capital Current ratio Receivables over Simes Average days to coled accounts receivable days days inventory Average days Debr eres eamed lines Plant assets to long-term deb Asset lumover % Relum on investment Relum an ey per share Eamings per shar Price-eamings re Dividend yd e d. L A P P A P 4 nek daye N nek N N N per share per share e. f. g. h. i. j. k. 1. m. n. O. P. g. I. S. 365 Turnover (d.) Cost of goods sold + Avg. inventory 365+ Turnover (f.) Total liabilities + Total assets Total liabilities + Total stockholders' equity (Income before interest + taxes) Interest Plant assets + Long-term debt Net income + Net sales Net sales Avg. total assets Net income + Avg. total assets OR (1.) (m.) Net income+ Avg. stockholders' equity Net income Preferred dividend Average common shares outstanding - Stockholders' equity Preferred rights Avg. common shares outstanding Market price per share + EPS Dividends per share+ Market price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts