Question: Needing help on these 2 problems please! Use the following facts for Multiple Choice problems 21-27. Assume a parent company acquired 80% of the outstanding

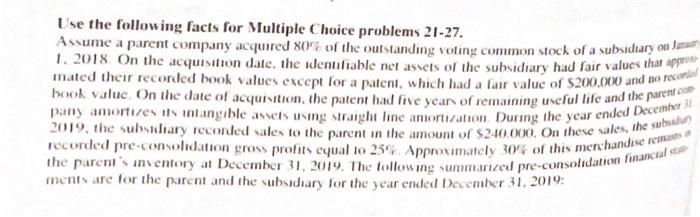

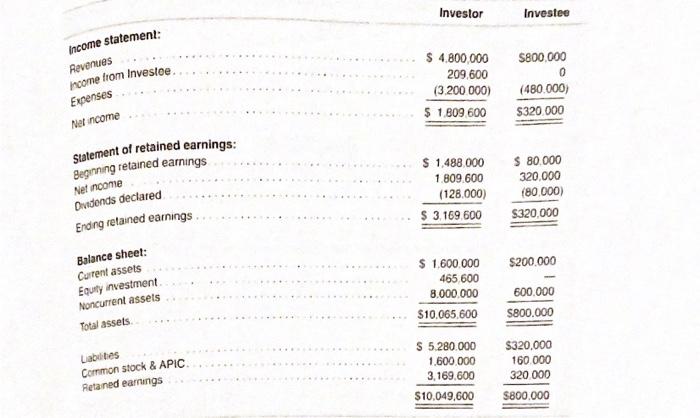

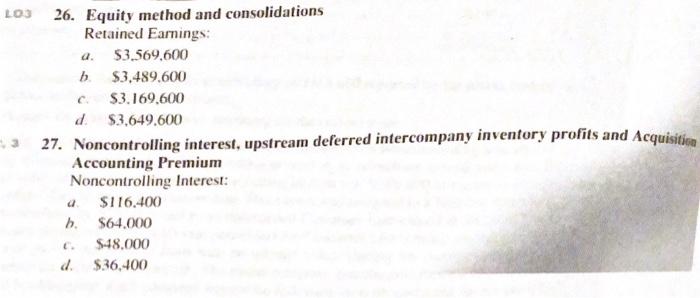

Use the following facts for Multiple Choice problems 21-27. Assume a parent company acquired 80% of the outstanding voting common stock of a subsidiary on Januar mated their recorted book values except for a patent, which had a fair value of $200,000 and no recordar book value. On the date of acquisition, the patent had five years of remaining useful life and the parece puny amortives us intangible assets using praight line and creation. During the year ended Decembering 2019, the subsidiary recorded sales to the parent in the amount of $240.000. On these sales, the sus recorded pre-consolidation gross profits equal to 256 Approximately 30% of this merchandise rema the parchi's inventory at December 31, 2019. The following umanized pre-consolidation financial ments are for the parent and the subsidiary for the year ended December 31, 2019: Investor Investee $800,000 Income statement: Revenues ncome from Investee Expenses Net ncome $ 4,800,000 209,600 (3.200 000) $ 1.809.600 (480.000) $320 000 Statement of retained earnings: Beginning retained earnings Net income $ 1,488 000 1 809.600 (128.000) $ 3.169.600 $ 80.000 320,000 (80.000 $320,000 Dividends declared Ending retained earnings Balance sheet: Current assets Equity investment Noncurrent assets Total assets. $200.000 $ 1.600.000 465,600 8.000.000 $10,065.600 600.000 $800.000 Labtes Common stock & APIC Retaned earrings S 5.280.000 1.600.000 3,169.600 $10,049,600 $320,000 160 000 320 000 S800,000 LO3 26. Equity method and consolidations Retained Earnings: $3.569,600 b. $3,489,600 $3.169.600 d $3,649.600 * 27. Noncontrolling interest, upstream deferred intercompany inventory profits and Acquisiton Accounting Premium Noncontrolling Interest: $116.400 h. $64.000 $48.000 d. $36,400 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts