Question: needing help Our company is evaluating a project with the projected future annual cash flows shown as follows and an appropriate cost of capital of

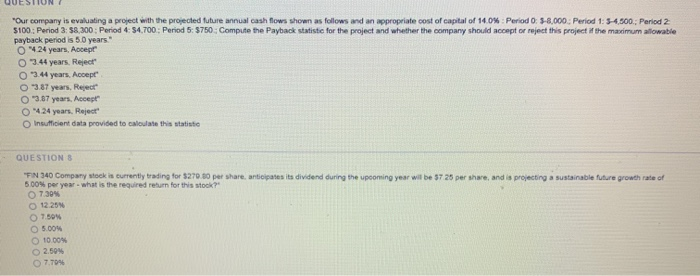

Our company is evaluating a project with the projected future annual cash flows shown as follows and an appropriate cost of capital of 14.0%: Period O. 5-8,000: Period 1: 5-4.500.: Period 2 5100: Period 3: 58,300: Period 4 54,700.: Period 5: $750: Compute the Payback statistic for the project and whether the company should accept or reject this project it the mascimum allowable payback period is 50 years." 0 14 24 years, Accept 3.44 years. Reject O 3.44 years. Accept O 3.87 years, Reject O "3.87 years, Accept 0 14 24 years. Reject Insufficient data provided to calculate this statistio QUESTIONS "FIN 340 Company stock is currently trading for $270.00 per share, anticipates its dividend during the upcoming year will be 57 25 pershare, and is projecting a sustainable future growth rate of 5.00% per year what is the required return for this stock? 730% O 12.25 7.50 5.00% 10.00 2.50 7.704

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts