Question: Needing help to solve this problem for Intermediate Accounting II EX.14-04 Algo On January 1, 2016, Knorr Corporation issued $900,000 of 6%, 5-year bonds dated

Needing help to solve this problem for Intermediate Accounting II

EX.14-04 Algo

On January 1, 2016, Knorr Corporation issued $900,000 of 6%, 5-year bonds dated January 1, 2016. The bonds pay interest annually on December 31. The bonds were issued to yield 7%. Bond issue costs associated with the bonds totaled $10,687.46.

Required:

| January 1, 2016 | Sold the bonds at an effective rate of 7% | ||

|---|---|---|---|

| journal entries to record the following: | |||

| December 31, 2016 | First interest payment using the effective interest method | ||

| December 31, 2016 | Amortization of bond issue costs using the straight-line method | ||

| December 31, 2017 | Second interest payment using the effective interest method | ||

| December 31, 2017 | Amortization of bond issue costs using the straight-line method | ||

CHART OF ACCOUNTSKnorr CorporationGeneral Ledger

| ASSETS | ||

|---|---|---|

| 111 | Cash | |

| 121 | Accounts Receivable | |

| 141 | Inventory | |

| 152 | Prepaid Insurance | |

| 181 | Equipment | |

| 195 | Deferred Bond Issue Costs | |

| 198 | Accumulated Depreciation | |

| LIABILITIES | ||

| 211 | Accounts Payable | |

| 231 | Salaries Payable | |

| 250 | Unearned Revenue | |

| 255 | Bonds Payable | |

| 256 | Premium on Bonds Payable | |

| 257 | Discount on Bonds Payable | |

| 261 | Income Taxes Payable |

| EQUITY | ||

|---|---|---|

| 311 | Common Stock | |

| 331 | Retained Earnings | |

| REVENUE | ||

| 411 | Sales Revenue |

| EXPENSES | |

|---|---|

| 500 | Cost of Goods Sold |

| 511 | Insurance Expense |

| 512 | Utilities Expense |

| 521 | Salaries Expense |

| 532 | Bad Debt Expense |

| 540 | Interest Expense |

| 541 | Depreciation Expense |

| 559 | Miscellaneous Expenses |

| 910 | Income Tax Expense |

General Journal

journal entries to record the following:

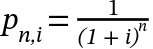

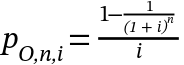

Additional Instructions Use PV Tables, Round to nearest 2 decimal places, record entries that match year

| January 1, 2016 | Sold the bonds at an effective rate of 7% |

|---|---|

| December 31, 2016 | First interest payment using the effective interest method |

| December 31, 2016 | Amortization of bond issue costs using the straight-line method |

| December 31, 2017 | Second interest payment using the effective interest method |

| December 31, 2017 | Amortization of bond issue costs using the straight-line method |

PAGE 2016

GENERAL JOURNAL

| DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | |

|---|---|---|---|---|---|

1 | |||||

2 | |||||

3 | |||||

4 | |||||

5 | |||||

6 | |||||

7 | |||||

8 | |||||

9 | |||||

10 |

PAGE 2017

GENERAL JOURNAL

| DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | |

|---|---|---|---|---|---|

1 | |||||

2 | |||||

3 | |||||

4 | |||||

5 |

Table 3 - Present Value of 1:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts