Question: Needing help with question 1, please show step by step how you get to solution. BI Uab x, X ADA Paragraph Styles Editor XXX For

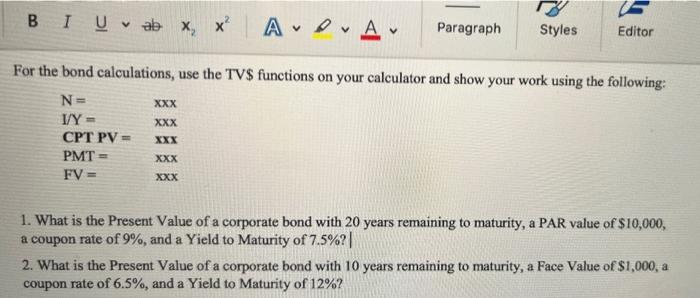

BI Uab x, X ADA Paragraph Styles Editor XXX For the bond calculations, use the TV$ functions on your calculator and show your work using the following: N= I/Y - CPT PV = PMT FV = XXX XXX XXX 1. What is the Present Value of a corporate bond with 20 years remaining to maturity, a PAR value of $10,000, a coupon rate of 9%, and a Yield to Maturity of 7.5%? 2. What is the Present Value of a corporate bond with 10 years remaining to maturity, a Face Value of $1,000, a coupon rate of 6.5%, and a Yield to Maturity of 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts