Question: needing help with these questions QUESTION 27 If a preferred stock from Pfizer Inc. (PFE) pays $5.00 in annual dividends, and the required return on

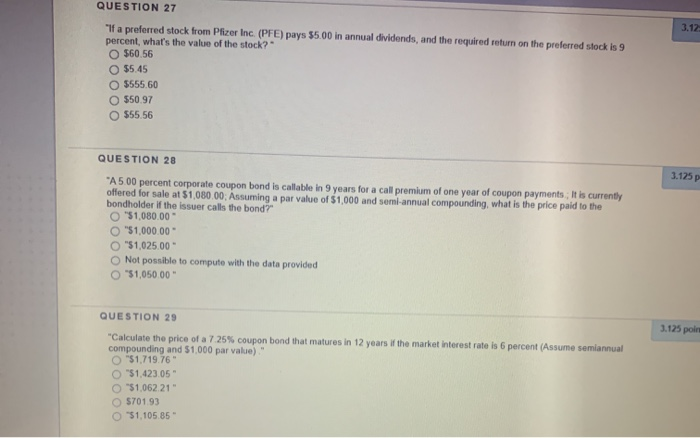

QUESTION 27 "If a preferred stock from Pfizer Inc. (PFE) pays $5.00 in annual dividends, and the required return on the preferred stockis 9 percent, what's the value of the stock?" $60.56 55.45 $555 60 550.97 $55 56 QUESTION 28 3.125 "A500 percent Corporate coupon bond is callable in 9 years for a call premium of one year of coupon payments. It is currently offered for sale at $1,080.00. Assuming a par value of $1,000 and semi-annual compounding, what is the price paid to the bondholder if the issuer calls the bond O "$1,080.00 O "$1,000.00 O "$1,025.00 Not possible to compute with the data provided O"51,050.00" QUESTION 29 1.125 pol "Calculate the price of a 7.25% coupon bond that matures in 12 years of the market interest rate is 6 percent (Assume semiannual compounding and $1,000 par value)" "51.719 76 "51,423.05 "51.062 21" 5701 93 "51.105 85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts