Question: Needing help with this 1040 Form assignment. If its possible I would like an example of the results on a 1040 Form document. Thnxs in

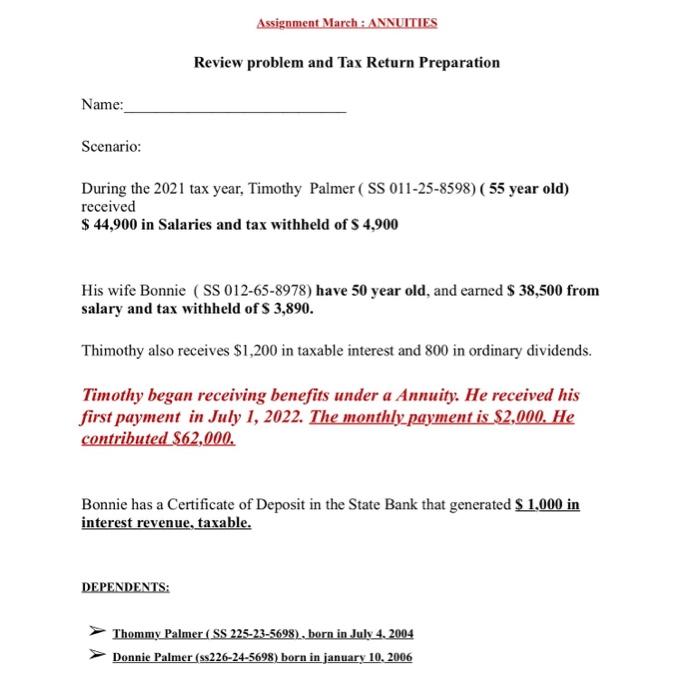

Assignment March : ANVUITIES Review problem and Tax Return Preparation Name: Scenario: During the 2021 tax year, Timothy Palmer ( SS 011-25-8598) ( 55 year old) received $44,900 in Salaries and tax withheld of $4,900 His wife Bonnie ( SS 012-65-8978) have 50 year old, and earned $38,500 from salary and tax witheld of S3,890. Thimothy also receives $1,200 in taxable interest and 800 in ordinary dividends. Timothy began receiving benefits under a Annuity. He received his first payment in July 1, 2022. The monthly payment is $2,000. He contributed $62,000. Bonnie has a Certificate of Deposit in the State Bank that generated $1,000 in interest revenue, taxable. DEPENDENTS: Thommy Palmer (SS 225-23-5698), born in July 4.2004 Donnie Palmer (ss 226-24-5698) born in january 10, 2006

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts