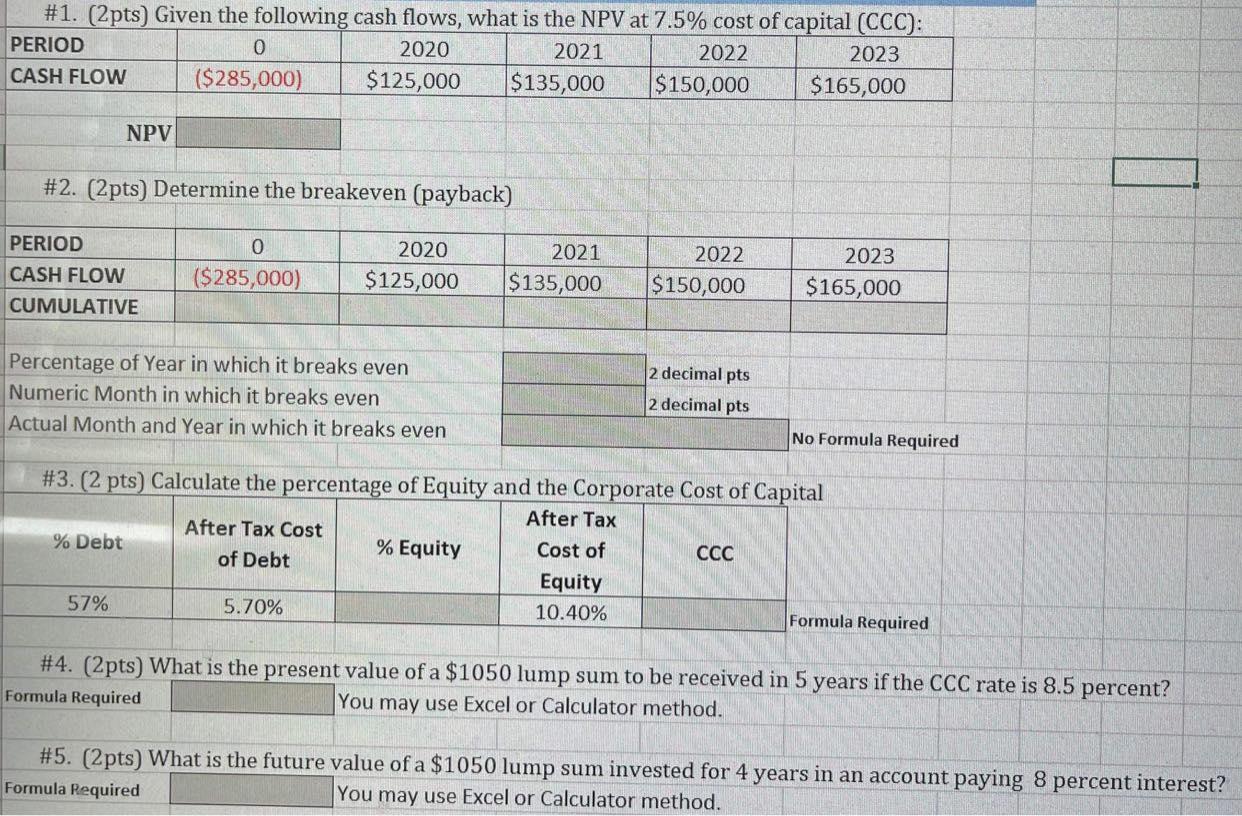

Question: Needs answers for #3 #4 and #5 Please and please show formulas #1. (2 pts) Given the following cash flows, what is the NPV at

Needs answers for #3 #4 and #5 Please and please show formulas

Needs answers for #3 #4 and #5 Please and please show formulas

#1. (2 pts) Given the following cash flows, what is the NPV at 7.5% cost of capital (CCC): PERIOD 0 2020 2021 2022 2023 CASH FLOW ($285,000) $125,000 $135,000 $150,000 $165,000 NPV #2. (2pts) Determine the breakeven (payback) 0 PERIOD CASH FLOW CUMULATIVE ($285,000) 2020 $125,000 2021 $135,000 2022 $150,000 2023 $165,000 Percentage of Year in which it breaks even Numeric Month in which it breaks even Actual Month and Year in which it breaks even 2 decimal pts 2 decimal pts No Formula Required #3.(2 pts) Calculate the percentage of Equity and the Corporate Cost of Capital After Tax After Tax Cost % Debt % Equity Cost of CCC of Debt Equity 57% 5.70% 10.40% Formula Required #4. (2pts) What is the present value of a $1050 lump sum to be received in 5 years if the CCC rate is 8.5 percent? Formula Required You may use Excel or Calculator method. #5. (2pts) What is the future value of a $1050 lump sum invested for 4 years in an account paying 8 percent interest? Formula Required You may use Excel or Calculator method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts