Question: Needs explanation 2. A. Journalize the following transactions for a merchandising company. The journal page is on the next page. Omit explanations. (5 Marks -

Needs explanation

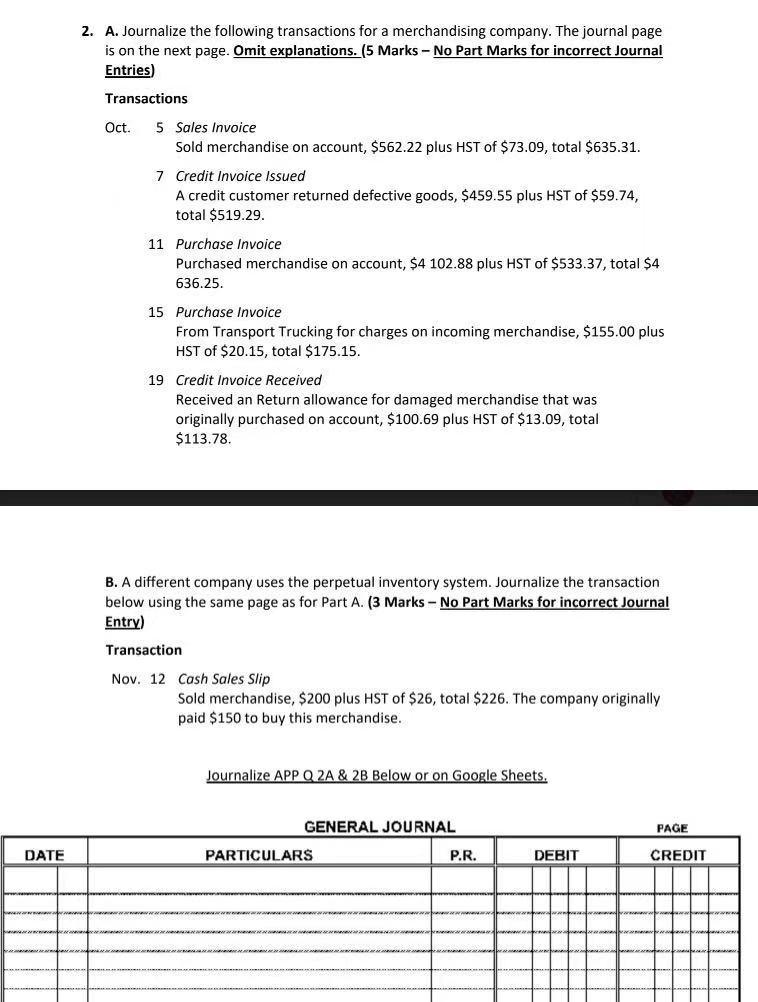

2. A. Journalize the following transactions for a merchandising company. The journal page is on the next page. Omit explanations. (5 Marks - No Part Marks for incorrect Journal Entries) Transactions Oct. 5 Sales Invoice Sold merchandise on account, $562.22 plus HST of $73.09, total $635.31. 7 Credit Invoice Issued A credit customer returned defective goods, $459.55 plus HST of $59.74, total $519.29. 11 Purchase Invoice Purchased merchandise on account, $4 102.88 plus HST of $533.37, total $4 636.25. 15 Purchase Invoice From Transport Trucking for charges on incoming merchandise, $155.00 plus HST of $20.15, total $175.15. 19 Credit Invoice Received Received an Return allowance for damaged merchandise that was originally purchased on account, $100.69 plus HST of $13.09, total $113.78. B. A different company uses the perpetual inventory system. Journalize the transaction below using the same page as for Part A. (3 Marks - No Part Marks for incorrect Journal Entry) Transaction Nov. 12 Cash Sales Slip Sold merchandise, $200 plus HST of $26, total $226. The company originally paid $150 to buy this merchandise. Journalize APP Q 2A & 2B Below or on Google Sheets. GENERAL JOURNAL PAGE DATE PARTICULARS P.R. DEBIT CREDIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts