Question: needs to be done excel Thus problem combines two familiar problems into one. 2. Consider a risky portfolio (a certain number of ETF's that mimics

needs to be done excel

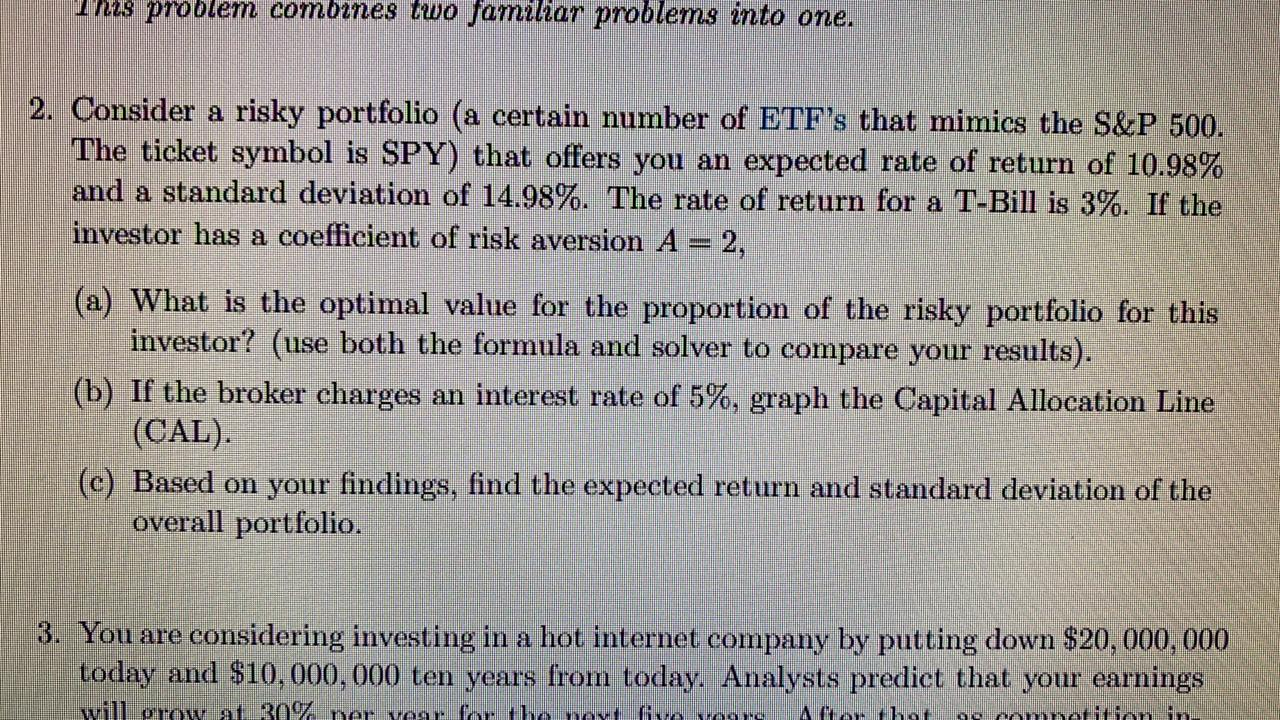

Thus problem combines two familiar problems into one. 2. Consider a risky portfolio (a certain number of ETF's that mimics the S&P 500. The ticket symbol is SPY) that offers you an expected rate of return of 10.98% and a standard deviation of 14.98%. The rate of return for a T-Bill is 3%. If the investor has a coefficient of risk aversion A= 2, (a) What is the optimal value for the proportion of the risky portfolio for this investor? (use both the formula and solver to compare your results). (b) If the broker charges an interest rate of 5%, graph the Capital Allocation Line (CAL). (c) Based on your findings, find the expected return and standard deviation of the overall portfolio. 3. You are considering investing in a hot internet company by putting down $20,000,000 today and $10,000,000 ten years from today. Analysts predict that your earnings will prow at 30% per year for the next five regra AN comotion in Thus problem combines two familiar problems into one. 2. Consider a risky portfolio (a certain number of ETF's that mimics the S&P 500. The ticket symbol is SPY) that offers you an expected rate of return of 10.98% and a standard deviation of 14.98%. The rate of return for a T-Bill is 3%. If the investor has a coefficient of risk aversion A= 2, (a) What is the optimal value for the proportion of the risky portfolio for this investor? (use both the formula and solver to compare your results). (b) If the broker charges an interest rate of 5%, graph the Capital Allocation Line (CAL). (c) Based on your findings, find the expected return and standard deviation of the overall portfolio. 3. You are considering investing in a hot internet company by putting down $20,000,000 today and $10,000,000 ten years from today. Analysts predict that your earnings will prow at 30% per year for the next five regra AN comotion in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts