Question: Needs to be done without excel formulas. You own 1,200 shares of Banner Co. stock is currently priced at $42 a share. Given this price,

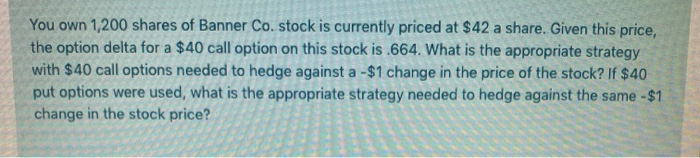

You own 1,200 shares of Banner Co. stock is currently priced at $42 a share. Given this price, the option delta for a $40 call option on this stock is .664. What is the appropriate strategy with $40 call options needed to hedge against a - $1 change in the price of the stock? If $40 put options were used, what is the appropriate strategy needed to hedge against the same - $1 change in the stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts