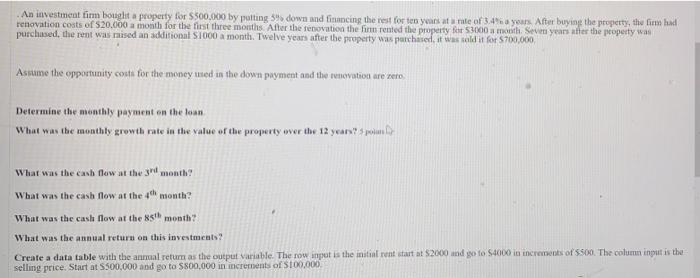

Question: Needs to be in excel showing cell reference first picture is questions second picture is data An investment firm bought a property for $500.000 by

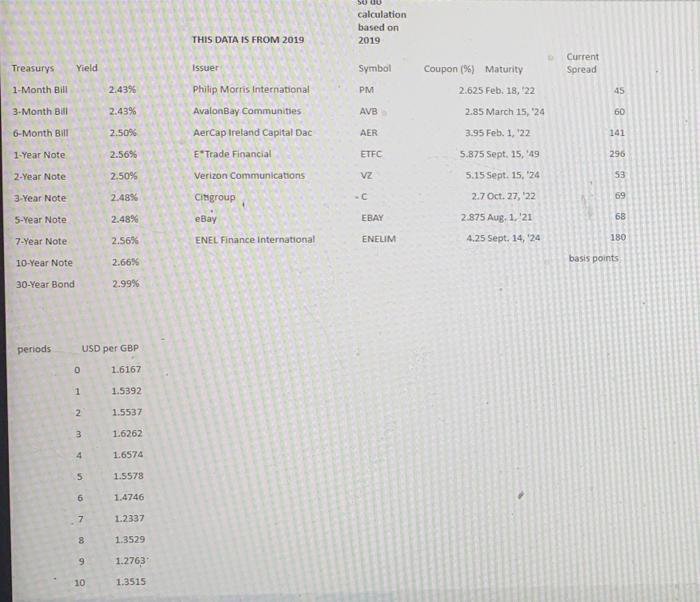

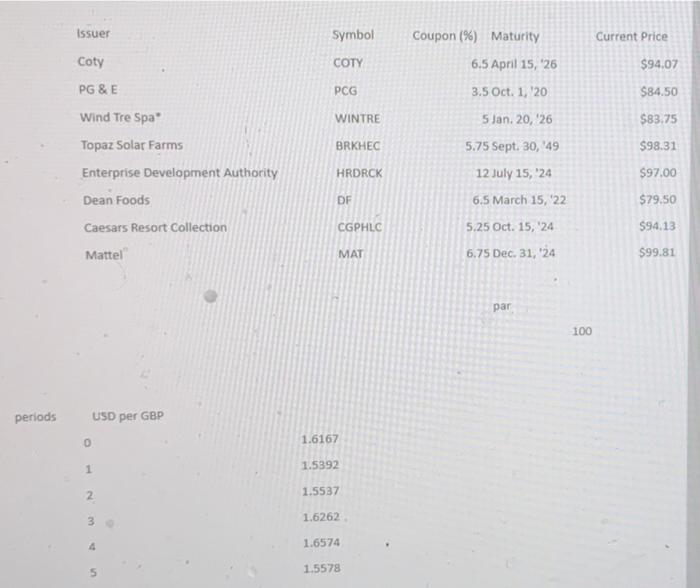

An investment firm bought a property for $500.000 by putting 3% down and fining the rest for ten years at male of 34 years After buying the property, the firm bad renovation costs of 520.000 a month for the first three months. After the renovation the firm rented the property ft3000 month. Seven years after the property was purchased the rent was raised an additional $1000 a month. Twelve years after the property was purchased it was told it for 5700.000 Assume the opportunity costs for the money med in the down payment and the renovation are vero Determine the monthly payment on the loan What was the monthly growth rate in the value of the property ower the 12 years post What was the cash flow at the month What was the cash flow at the ch month? What was the cash flow at the 85th month What was the annual return on this investments? Create a data table with the annual return as the output variable. The row input is the initial rent start at $2000 and go to $4000 in increments of $500. The column input is the selling price. Start at $500,000 and go to $800,000 in increments of S100.000 5000 calculation based on 2019 THIS DATA IS FROM 2019 Treasurys Yield issuer Current Spread Symbol Coupon (95) Maturity 2.625 Feb. 18, 22 1-Month Bill 2.43% PM 45 3-Month B 2.43% Philip Morris International Avalon Bay Communities AerCap Ireland Capital Dac AVB 2.85 March 15, 24 60 6-Month Bill 2.50% AER 3.95 Feb. 1, 22 141 1-Year Note 2.56% E'Trade Financial ETFC 5.875 Sept. 15,49 296 2-Year Note 2.50% Verizon Communications VZ 5.15 Sept. 15, 24 53 3-Year Note 2.4896 Citigroup - 69 5-Year Note 2.48% eBay EBAY 2.7 Oct. 27,22 2.875 Aug, 1.21 4.25 Sept. 14,24 68 7-Year Note 2.56% ENEL Finance International ENELIM 180 10-Year Note 2.66% basis points 30-Year Bond 2.99% periods USD per GBP 0 1.6167 1 1.5392 2 1.5537 3 1.6262 4 1.6574 5 1.5578 6 1.4746 7 1.2337 8 13529 9 1.2763 10 1.3515 Issuer Symbol Current Price Coupon (%) Maturity 6.5 April 15, 26 Coty COTY $94.07 PG & E PCG 3.5 Oct. 1, 20 $84.50 WINTRE $83.75 BRKHEC $98.31 5 Jan 20, 26 5.75 Sept. 30, 49 12 July 15, 24 6.5 March 15, 22 HRDRCK Wind Tre Spa' Topaz Solar Farms Enterprise Development Authority Dean Foods Caesars Resort Collection Mattel $97.00 DF $79.50 CGPHLC $94.13 5.25 Oct. 15, 24 6.75 Dec. 31, 24 MAT $99.81 par 100 periods USD per GBP 0 1.6167 1 1.5392 2 1.5537 3 1.6262 1.6574 4 1.5578 An investment firm bought a property for $500.000 by putting 3% down and fining the rest for ten years at male of 34 years After buying the property, the firm bad renovation costs of 520.000 a month for the first three months. After the renovation the firm rented the property ft3000 month. Seven years after the property was purchased the rent was raised an additional $1000 a month. Twelve years after the property was purchased it was told it for 5700.000 Assume the opportunity costs for the money med in the down payment and the renovation are vero Determine the monthly payment on the loan What was the monthly growth rate in the value of the property ower the 12 years post What was the cash flow at the month What was the cash flow at the ch month? What was the cash flow at the 85th month What was the annual return on this investments? Create a data table with the annual return as the output variable. The row input is the initial rent start at $2000 and go to $4000 in increments of $500. The column input is the selling price. Start at $500,000 and go to $800,000 in increments of S100.000 5000 calculation based on 2019 THIS DATA IS FROM 2019 Treasurys Yield issuer Current Spread Symbol Coupon (95) Maturity 2.625 Feb. 18, 22 1-Month Bill 2.43% PM 45 3-Month B 2.43% Philip Morris International Avalon Bay Communities AerCap Ireland Capital Dac AVB 2.85 March 15, 24 60 6-Month Bill 2.50% AER 3.95 Feb. 1, 22 141 1-Year Note 2.56% E'Trade Financial ETFC 5.875 Sept. 15,49 296 2-Year Note 2.50% Verizon Communications VZ 5.15 Sept. 15, 24 53 3-Year Note 2.4896 Citigroup - 69 5-Year Note 2.48% eBay EBAY 2.7 Oct. 27,22 2.875 Aug, 1.21 4.25 Sept. 14,24 68 7-Year Note 2.56% ENEL Finance International ENELIM 180 10-Year Note 2.66% basis points 30-Year Bond 2.99% periods USD per GBP 0 1.6167 1 1.5392 2 1.5537 3 1.6262 4 1.6574 5 1.5578 6 1.4746 7 1.2337 8 13529 9 1.2763 10 1.3515 Issuer Symbol Current Price Coupon (%) Maturity 6.5 April 15, 26 Coty COTY $94.07 PG & E PCG 3.5 Oct. 1, 20 $84.50 WINTRE $83.75 BRKHEC $98.31 5 Jan 20, 26 5.75 Sept. 30, 49 12 July 15, 24 6.5 March 15, 22 HRDRCK Wind Tre Spa' Topaz Solar Farms Enterprise Development Authority Dean Foods Caesars Resort Collection Mattel $97.00 DF $79.50 CGPHLC $94.13 5.25 Oct. 15, 24 6.75 Dec. 31, 24 MAT $99.81 par 100 periods USD per GBP 0 1.6167 1 1.5392 2 1.5537 3 1.6262 1.6574 4 1.5578

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts