Question: Needs to be solved in Excel Please include all the math work and formulas used in Excel! Tax Problem A production equipment at a cost

Needs to be solved in Excel Please include all the math work and formulas used in Excel!

Needs to be solved in Excel Please include all the math work and formulas used in Excel!

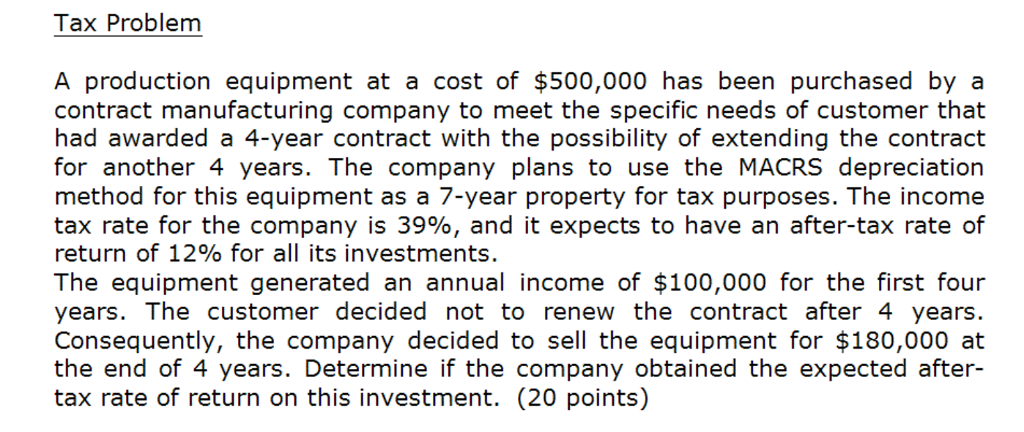

Tax Problem A production equipment at a cost of $500,000 has been purchased by a contract manufacturing company to meet the specific needs of customer that had awarded a 4-year contract with the possibility of extending the contract for another 4 years. The company plans to use the MACRS depreciation method for this equipment as a 7-year property for tax purposes. The income tax rate for the company is 39%, and it expects to have an after-tax rate of return of 12% for all its investments. The equipment generated an annual income of $100,000 for the first four years. The customer decided not to renew the contract after 4 years. Consequently, the company decided to sell the equipment for $180,000 at the end of 4 years. Determine if the company obtained the expected after- tax rate of return on this investment. (20 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts