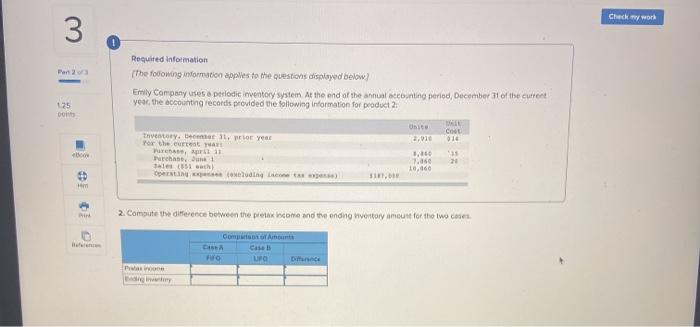

Question: needs to fill our blanks in the boxes under the question Check my work 3 Required information The following information applies to the questions displayed

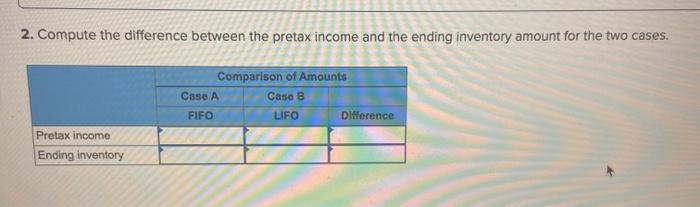

Check my work 3 Required information The following information applies to the questions displayed below Emily Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year the accounting records provided the following information for product 2: 125 DO Unite 2,010 Cout 016 theory. SYE For the current TALL Apr 11 Purchase Tale (151 sach) Diding 7.06 20 lo 19 18 2. Compute the difference between the preta come and the ending Hvertory amount for the two cases Com o Amount UFO 2. Compute the difference between the pretax income and the ending inventory amount for the two cases. Comparison of Amounts Case A Case B FIFO LIFO Difference Pretax income Ending inventory Check my work 3 Required information The following information applies to the questions displayed below Emily Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year the accounting records provided the following information for product 2: 125 DO Unite 2,010 Cout 016 theory. SYE For the current TALL Apr 11 Purchase Tale (151 sach) Diding 7.06 20 lo 19 18 2. Compute the difference between the preta come and the ending Hvertory amount for the two cases Com o Amount UFO 2. Compute the difference between the pretax income and the ending inventory amount for the two cases. Comparison of Amounts Case A Case B FIFO LIFO Difference Pretax income Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts