Question: NEEED HELP ASAP Mul Choice Question 34 Multiple Choice Question 35 Multiple Choice View Policies Current Attempt in Progress On January 1, 2020. Marin Corporation

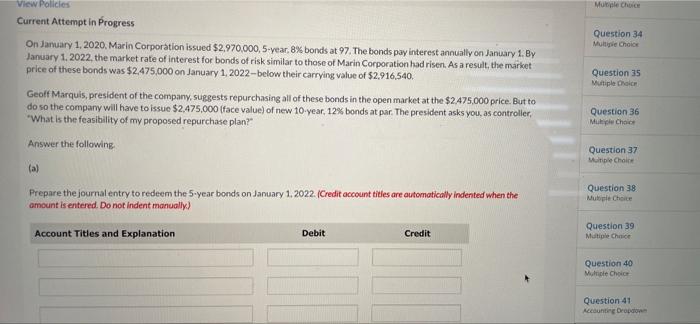

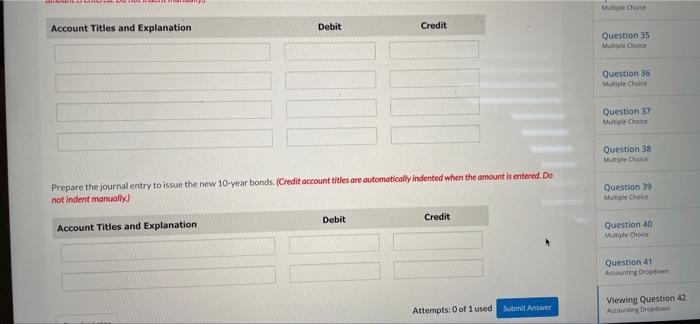

Mul Choice Question 34 Multiple Choice Question 35 Multiple Choice View Policies Current Attempt in Progress On January 1, 2020. Marin Corporation issued $2.970,000, 5-year, 8% bonds at 97. The bonds pay interest annually on January 1. By January 1, 2022, the market rate of interest for bonds of risk similar to those of Marin Corporation had risen. As a result, the market price of these bonds was $2,475,000 on January 1, 2022-below their carrying value of $2,916,540. Geoff Marquis, president of the company, suggests repurchasing all of these bonds in the open market at the $2.475.000 price. But to do so the company will have to issue $2,475,000 (face value of new 10 year, 12% bonds at par. The president asks you, as controller "What is the feasibility of my proposed repurchase plan? Answer the following (a) Prepare the journal entry to redeem the 5-year bonds on January 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually) Question 36 Multiple choice Question 37 Mine Choice Question 38 Muble Choice Account Titles and Explanation Debit Credit Question 39 Multiple Choice Question 40 Multicle Choice Question 41 Accounting Dropdo Miehet Account Titles and Explanation Debit Credit Question 35 Me Chic Question 36 Multiple Choice Question 37 Mutile Choir Question 38 Multicho Prepare the journal entry to issue the new 10-year bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) Question 39 Multiple choice Debit Credit Account Titles and Explanation Question 40 Me Choice Question 41 Account Diap Attempts: 0 of 1 used Submit Answer Viewing Question 42 Accounting broad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts