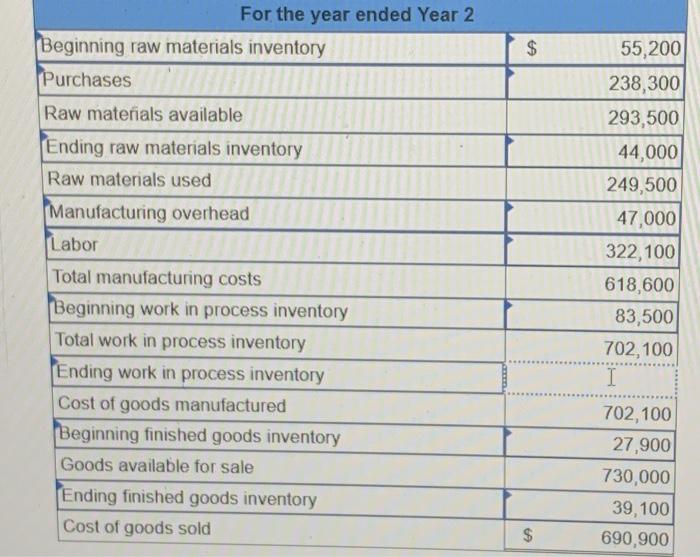

Question: nees help determining Ending Work in Process Inventory For the year ended Year 2 Munoz Corporation began fiscal Year 2 with the following balances in

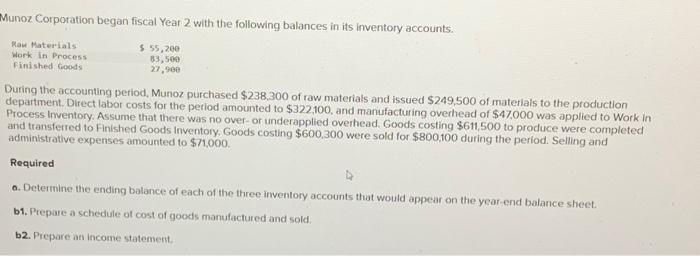

For the year ended Year 2 Munoz Corporation began fiscal Year 2 with the following balances in its inventory accounts. During the accounting period, Munoz purchased $238,300 of raw materials and issued $249,500 of materiais to the production department. Direct labor costs for the period amounted to $322100, and manufacturing overhead of $47.000 was applied to Work in Process Inventory. Assume that there was no over-or underapplied overhead. Goods costing $611,500 to produce were completed and transferred to Finished Goods Inventory. Goods costing $600.300 were sold for $800,100 during the period. Selling and administratlve expenses amounted to $11,000. Required a. Determine the ending balance of each of the three inventory accounts that would appear on the year-end balance sheet. b1. Prepare a schedule ot cost of goods manufactured and sold b2. Prepare an income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts