Question: Negative beta assets most likely: Select one A . 1 trve positive correlations with the market portfolio. 0 . Do not provide any diversification

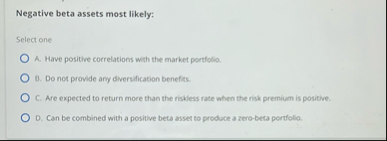

Negative beta assets most likely:

Select one

Atrve positive correlations with the market portfolio.

Do not provide any diversification benefis.

C Are expected to return more than the rithess rate when the risk premium is positive.

D Can be combined with a positive beta asset to produce a zerobeta portfolio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock