Question: Nen Projects sincer min presects floatation - s P c o s t o f Problem on Dividend Policy Residual policy Buena Terra Corporation is

Nen Projects sincer min presects

floatation

Problem on Dividend Policy Residual policy

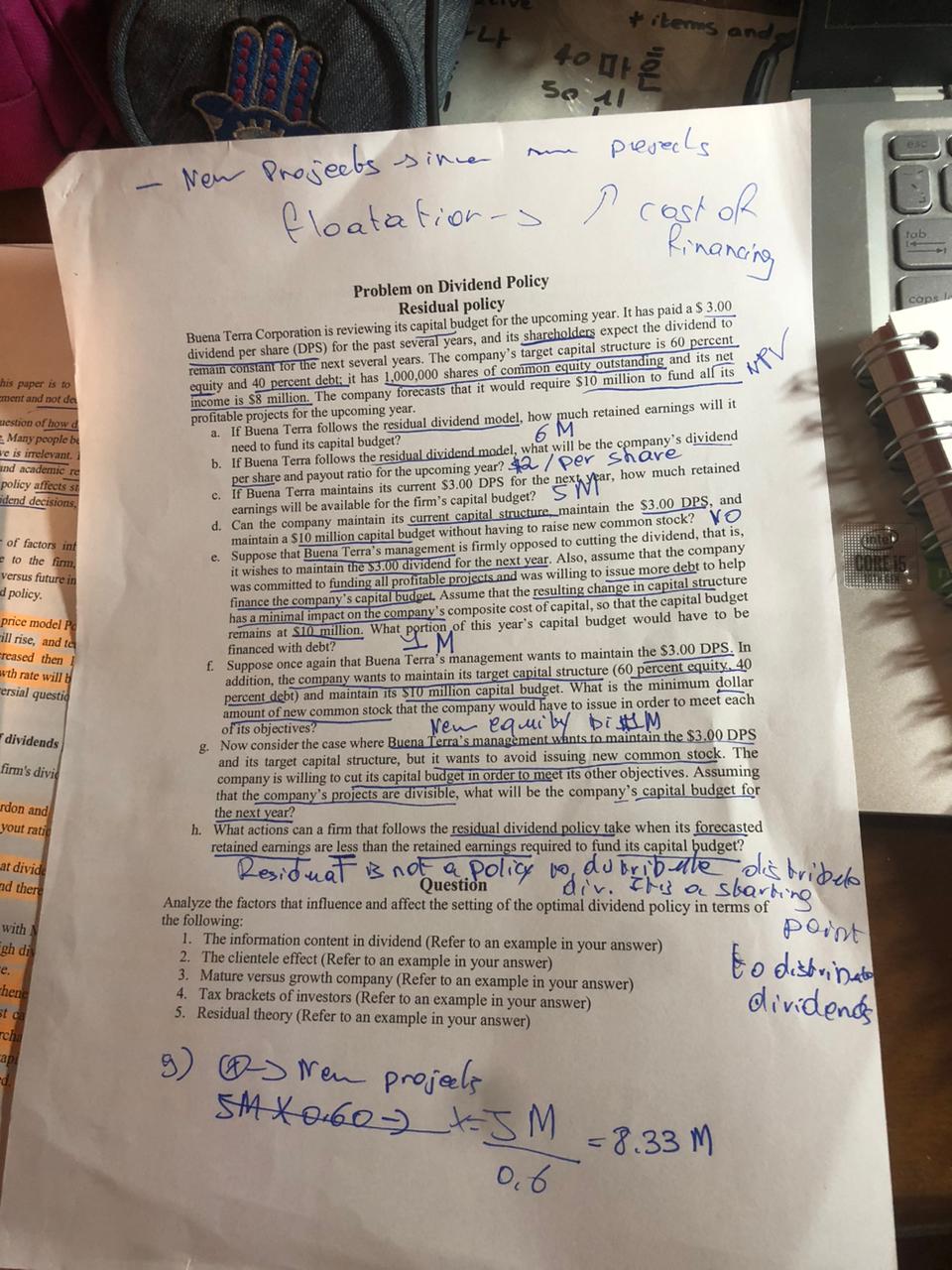

Buena Terra Corporation is reviewing its capital budget for the upcoming year. It has paid a $ dividend per share DPS for the past several years, and its shareholders expect the dividend to equity and percent debt: it has shares of common equity outstanding and its net a If Buena Terra follows the residual dividend model, how much need to fund its capital budget? b If Buena Terra follows the residual dividend model, what will ber

b If Buena Terra follows the residual dividend model, what will be the company's dividend cer share and payout ratio for the upcoming year? $ per Shave

earnings will be available for the firm's capital budget? d Can the company maintain its current capital structure. maintain the $ and maintain a $ million capital budget without having to raise new common stock? VO

maintain a $ million capital budget without having to raise new common stock? e Suppose that Buena Terra's management is firmly opposed to cutting the dividend, that is it wishes to maintain the dividend for the next year. Also, assume that the company

was committed to funding all profitable proiects and was willing to issue more debt to help finance the company's capital budget Assume that the resulting finance the company s capital budget. Assume that the resulting change in capital structure has a minimal impact on the company's composite cost of capital, so that the capital budget remains at S million. What pory remains at S million. What portion of this year's capital budget would have to be financed with debt? Suppose once again that Buena Terra's Suppose once again that Buena Terra's management wants to maintain the $ In addition, the company wants to maintain its target capital structure percent equity addition, the company wants to maintain its target capital structure percent equity. percent debt and maintain its slo million capital budget. What is the minimum dollar amount of new common stock that the company would amount of new common stock that the company would have to issue in order to meet each of its objectives? New consider the case where Buena Terra's management wants to maintain the $ DPS and its target capital structure, but it wants to avoid issuin company is willing to cut its capital budget in order to meet its other objectives. Assuming that the company's projects are divisible, what will be the company's capital budget for the next year?

h What actions can a firm that follows the residual dividend policy take when its forecasted Residuat is not a Policy odu bribule ale dis bribelo Question div. If is a skarbing Analyze the factors that influence and affect the setting of the optimal dividend policy in terms of the following:

The information content in dividend Refer to an example in The clientele effect Refer to an example in your answer

Mature versus growth company Refer to an example in your answer

Tax brackets of investors Refer to an example in your answer

Eo distrinato

Residual theory Refer to an example in your answer dividenos

ren projeels

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock