Question: nent Compounding More Frequent than Annually 4 . 1 2 . How much will $ 8 , 0 0 0 be worth in 8 years

nent

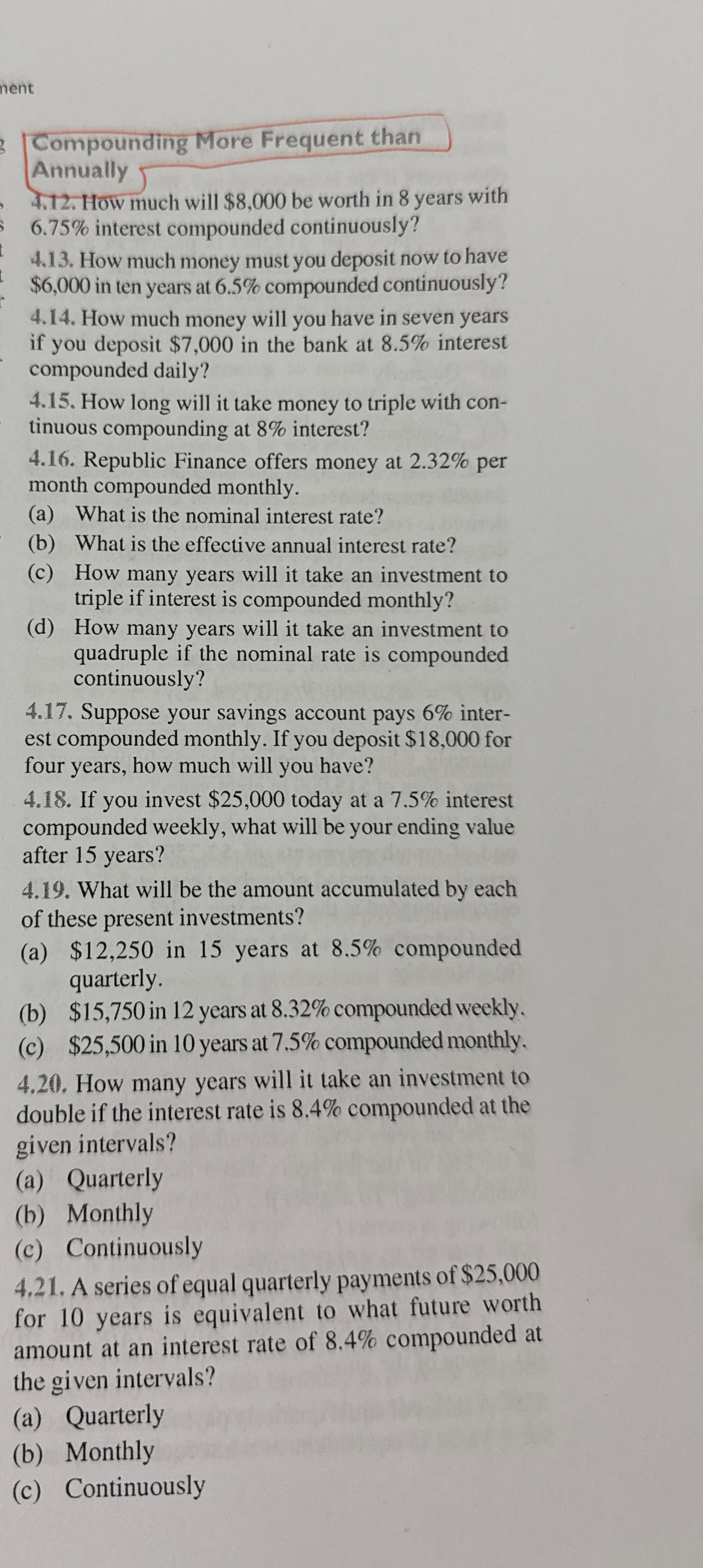

Compounding More Frequent than

Annually

How much will $ be worth in years with interest compounded continuously?

How much money must you deposit now to have $ in ten years at compounded continuously?

How much money will you have in seven years if you deposit $ in the bank at interest compounded daily?

How long will it take money to triple with continuous compounding at interest?

Republic Finance offers money at per month compounded monthly.

a What is the nominal interest rate?

b What is the effective annual interest rate?

c How many years will it take an investment to triple if interest is compounded monthly?

d How many years will it take an investment to quadruple if the nominal rate is compounded continuously?

Suppose your savings account pays interest compounded monthly. If you deposit $ for four years, how much will you have?

If you invest $ today at a interest compounded weekly, what will be your ending value after years?

What will be the amount accumulated by each of these present investments?

a $ in years at compounded quarterly.

b $ in years at compounded weekly.

c $ in years at compounded monthly,

How many years will it take an investment to double if the interest rate is compounded at the given intervals?

a Quarterly

b Monthly

c Continuously

A series of equal quarterly payments of $ for years is equivalent to what future worth amount at an interest rate of compounded at the given intervals?

a Quarterly

b Monthly

c Continuously

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock