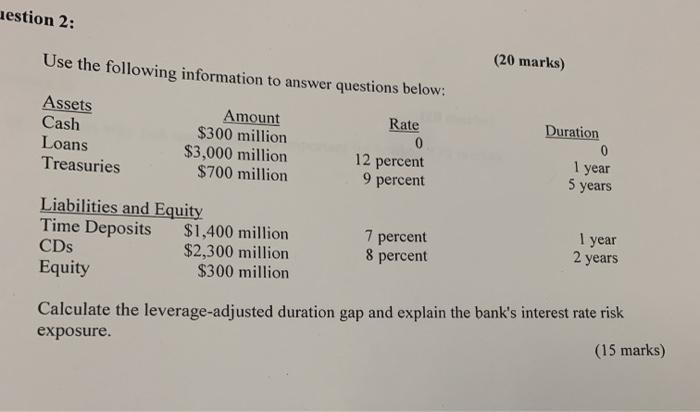

Question: nestion 2: Use the following information to answer questions below: (20 marks) Assets Cash Loans Treasuries Amount $300 million $3,000 million $700 million Rate 0

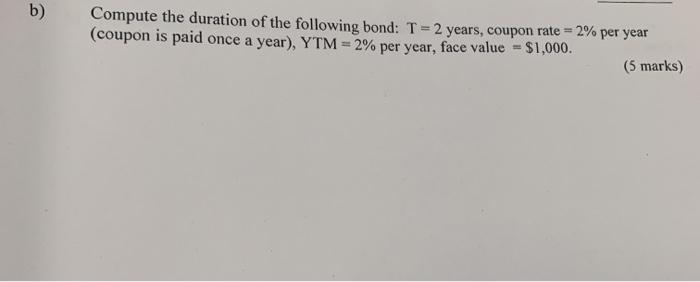

nestion 2: Use the following information to answer questions below: (20 marks) Assets Cash Loans Treasuries Amount $300 million $3,000 million $700 million Rate 0 12 percent 9 percent Duration 0 1 year 5 years Liabilities and Equity Time Deposits $1,400 million CDs $2,300 million Equity $300 million 7 percent 8 percent 1 year 2 years Calculate the leverage-adjusted duration gap and explain the bank's interest rate risk exposure. (15 marks) b) Compute the duration of the following bond: T=2 years, coupon rate = 2% per year (coupon is paid once a year), YTM = 2% per year, face value = $1,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock