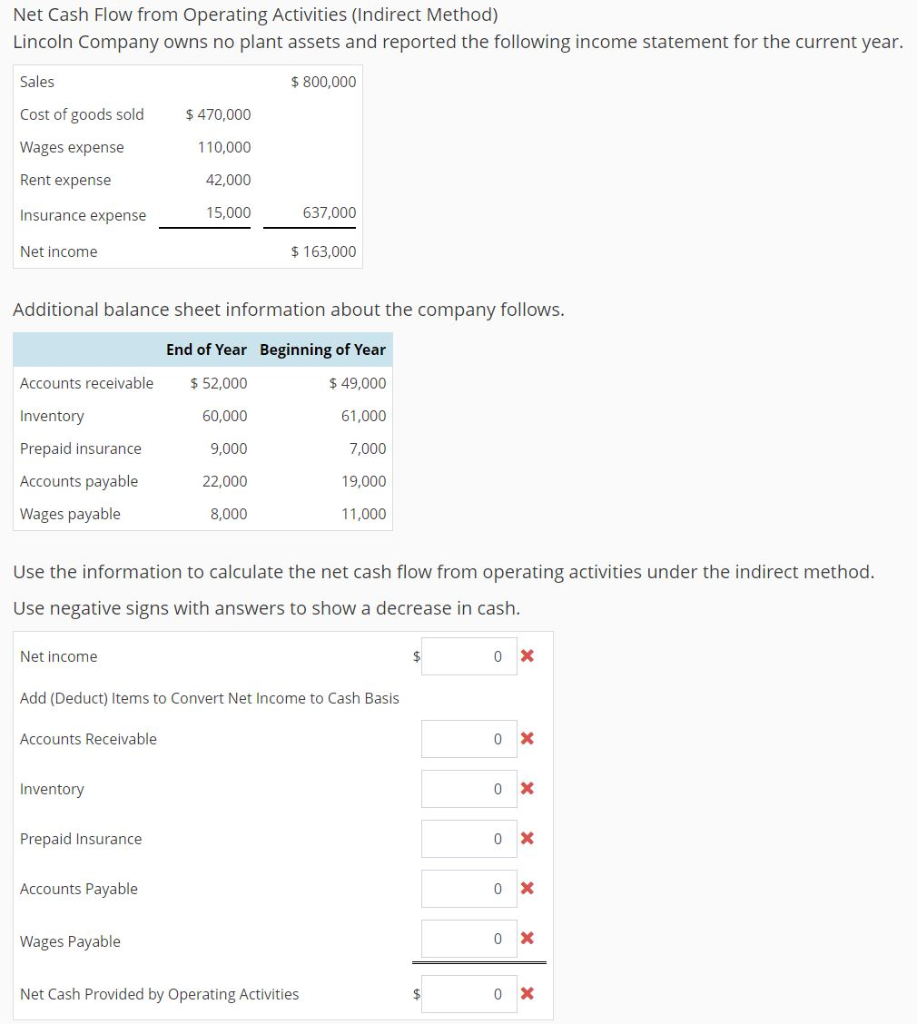

Question: Net Cash Flow from Operating Activities ( Indirect Method ) Lincoln Company owns no PP&E and reported the following income statement for the current year.

Net Cash Flow from Operating Activities Indirect Method

Lincoln Company owns no PP&E and reported the following income statement for the current year.

Sales$Cost of goods sold$Wages expenseRent expenseInsurance expenseNet income$

Additional balance sheet information about the company follows:

End of YearBeginning of YearAccounts receivable$$InventoryPrepaid insuranceAccounts payableWages payable

Use the information to calculate the net cash flow from operating activities under the indirect method.

Cash from operating activitiesCurrent YearAccounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Add Deduct reconciling items:Accounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Accounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Accounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Accounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Accounts payableAccounts receivableCost of goods soldInsurance expenseInventoryNet cash flow from operating activitiesNet incomePrepaid insuranceRent expenseSalesWages expenseWages payable Answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock