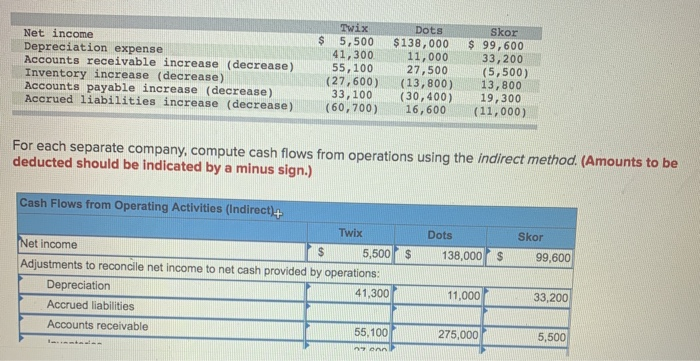

Question: $ Net income Depreciation expense Accounts receivable increase (decrease) Inventory increase (decrease) Accounts payable increase (decrease) Accrued liabilities increase (decrease) Twix 5,500 41,300 55,100 (27,600)

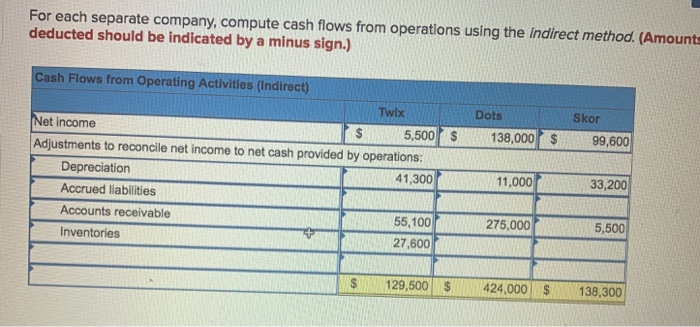

$ Net income Depreciation expense Accounts receivable increase (decrease) Inventory increase (decrease) Accounts payable increase (decrease) Accrued liabilities increase (decrease) Twix 5,500 41,300 55,100 (27,600) 33,100 (60,700) Dots $ 138,000 11,000 27,500 (13,800) (30,400) 16,600 Skor $ 99,600 33,200 (5,500) 13,800 19,300 (11,000) For each separate company, compute cash flows from operations using the indirect method. (Amounts to be deducted should be indicated by a minus sign.) Dots 138,000 Skor 99,600 $ $ Cash Flows from Operating Activities (Indirect)+ I Twix Net income R $ 5,500 Adjustments to reconcile net income to net cash provided by operations: Depreciation 41,300 Accrued liabilities Accounts receivable 55,100 11,000 3 3,200 275,000 5,500 For each separate company, compute cash flows from operations using the indirect method. (Amount: deducted should be indicated by a minus sign.) Dots 138,000 Skor 99,600 $ $ Cash Flows from Operating Activities (Indirect) TWix Net income 5,500 Adjustments to reconcile net income to net cash provided by operations: Depreciation 41,300 Accrued liabilities Accounts receivable 55,100 Inventories 27,600 11,000 33,200 275,000 5,500 $ 129,500 $ 424,000 $ 138,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts