Question: Net Income Difference using US GAAP and IFRS Combanv ABC Co. provided the following information for the 2020 vear ended. By how much the Net

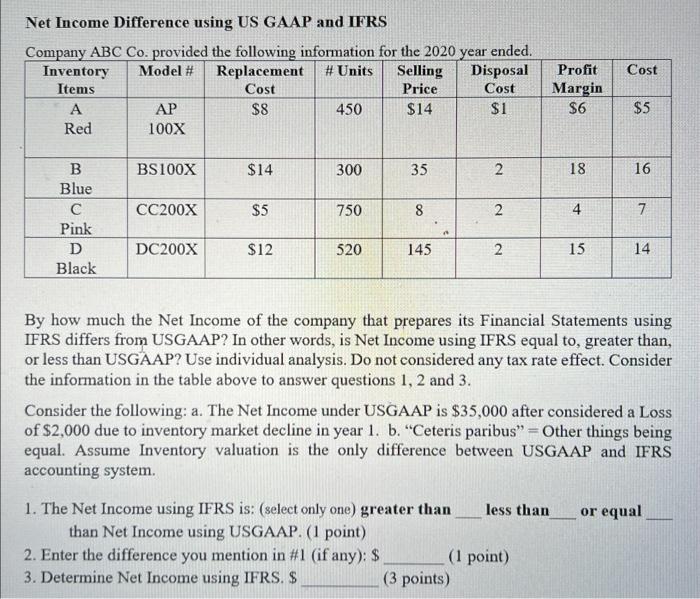

Net Income Difference using US GAAP and IFRS Combanv ABC Co. provided the following information for the 2020 vear ended. By how much the Net Income of the company that prepares its Financial Statements using IFRS differs from USGAAP? In other words, is Net Income using IFRS equal to, greater than, or less than USGAAP? Use individual analysis. Do not considered any tax rate effect. Consider the information in the table above to answer questions 1,2 and 3. Consider the following: a. The Net Income under USGAAP is $35,000 after considered a Loss of $2,000 due to inventory market decline in year 1. b. "Ceteris paribus" = Other things being equal. Assume Inventory valuation is the only difference between USGAAP and IFRS accounting system. 1. The Net Income using IFRS is: (select only one) greater than less than or equal than Net Income using USGAAP. (1 point) 2. Enter the difference you mention in #1 (if any): $ (1 point) 3. Determine Net Income using IFRS. \$ ( 3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts