Question: Net Income - EXTRA. You will not be tested on this type of question. 1. Susan makes $65 000.00 a year. She has decided that

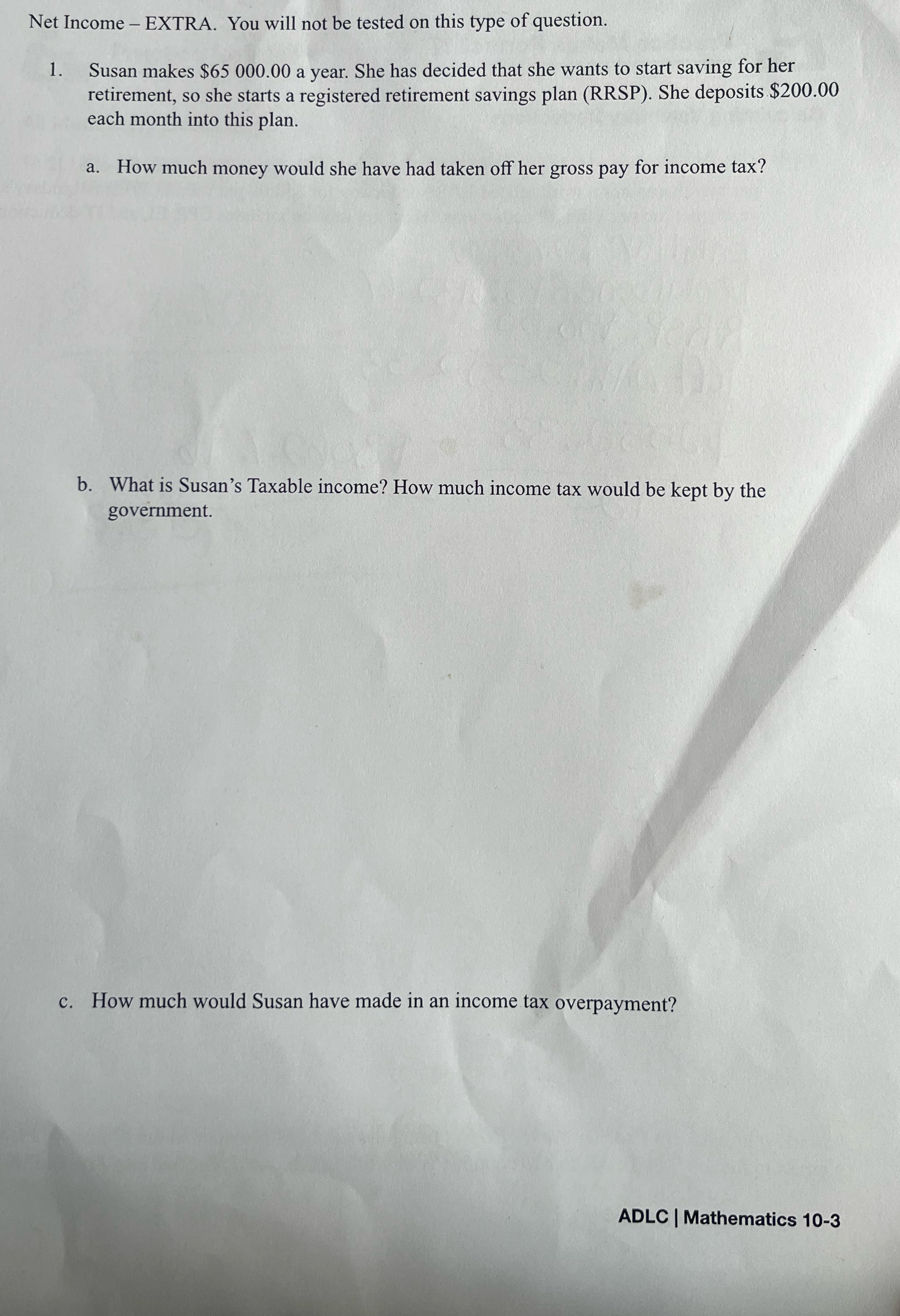

Net Income - EXTRA. You will not be tested on this type of question. 1. Susan makes $65 000.00 a year. She has decided that she wants to start saving for her retirement, so she starts a registered retirement savings plan (RRSP). She deposits $200.00 each month into this plan. a. How much money would she have had taken off her gross pay for income tax? b. What is Susan's Taxable income? How much income tax would be kept by the government. c. How much would Susan have made in an income tax overpayment? ADLC | Mathematics 10-3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock