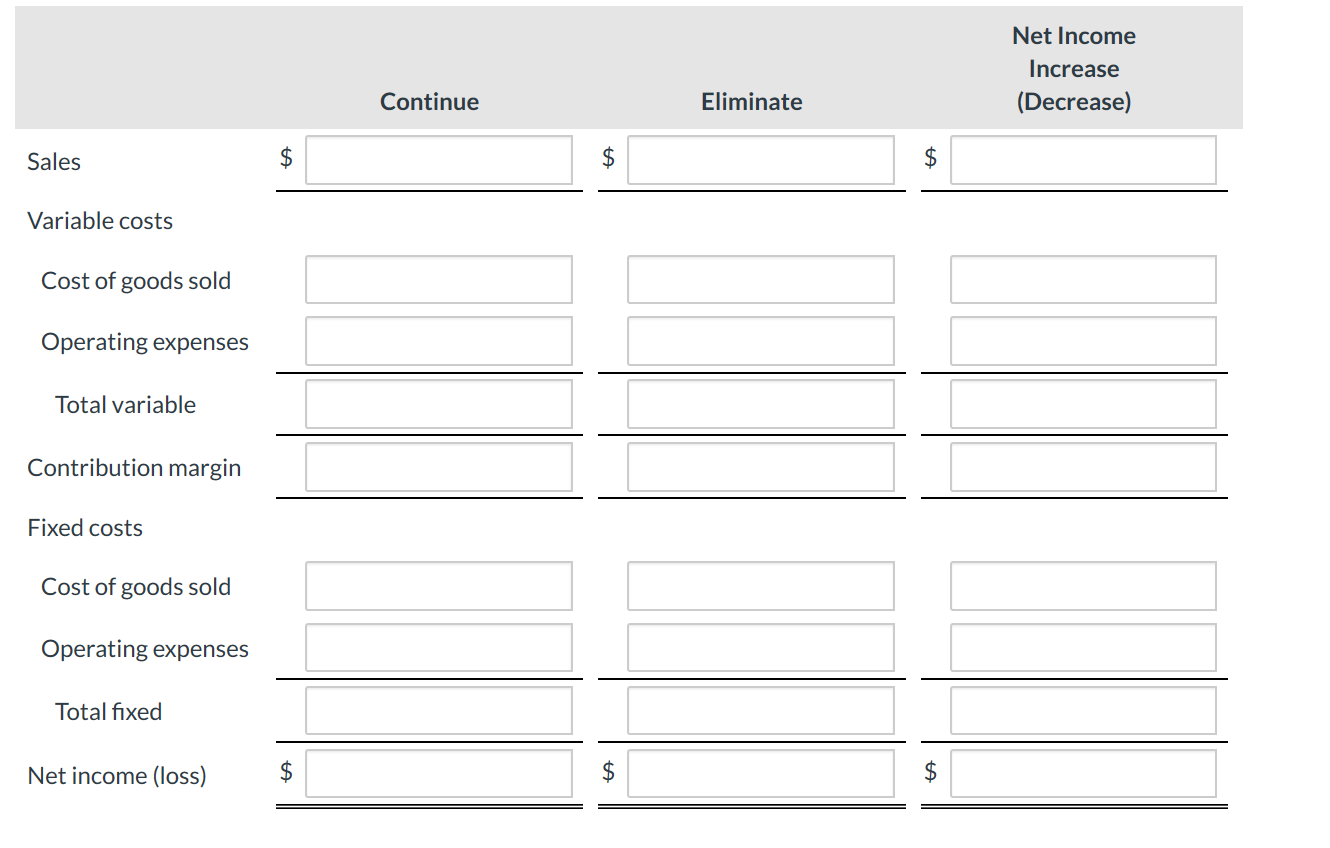

Question: Net Income Increase (Decrease) Continue Eliminate $ $ $ Sales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost

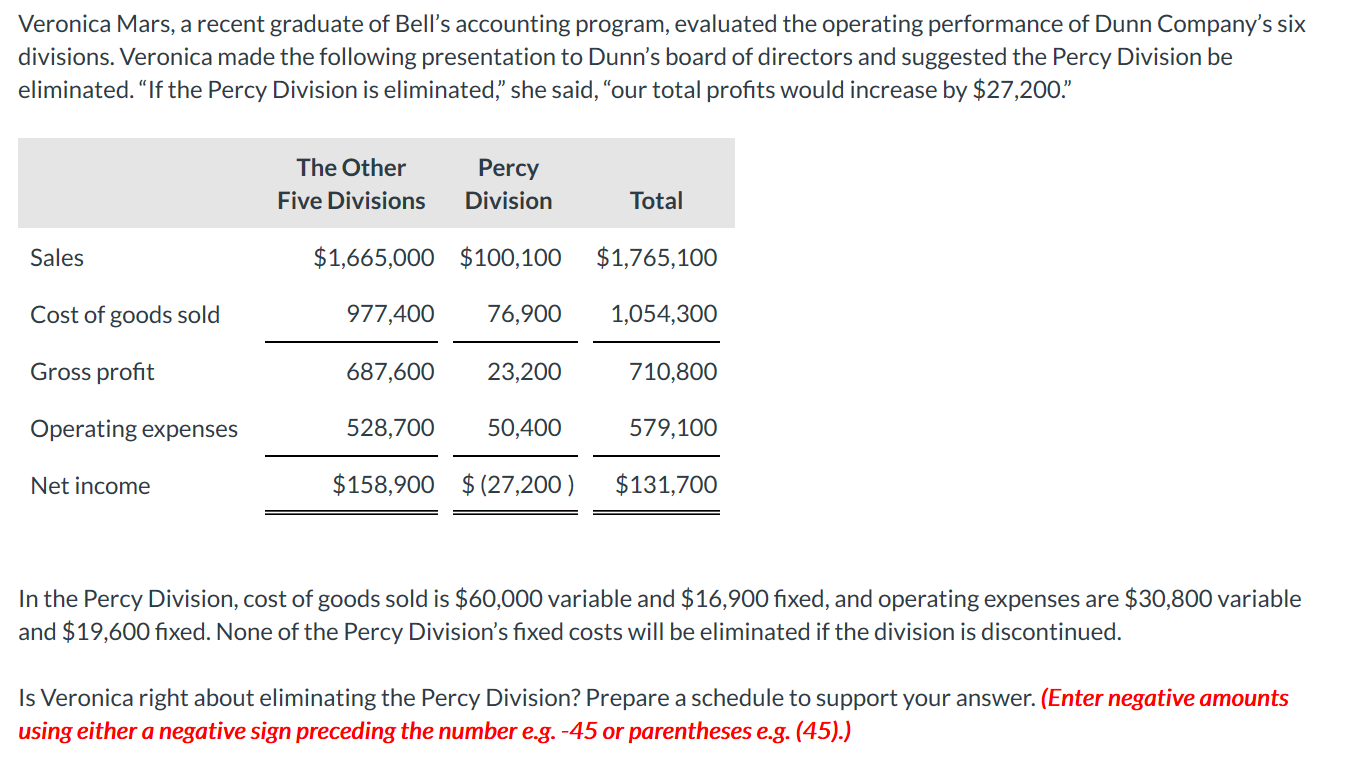

Net Income Increase (Decrease) Continue Eliminate $ $ $ Sales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Total fixed $ $ $ Net income (loss) tA tA Veronica Mars, a recent graduate of Bell's accounting program, evaluated the operating performance of Dunn Company's six divisions. Veronica made the following presentation to Dunn's board of directors and suggested the Percy Division be eliminated. "If the Percy Division is eliminated," she said, "our total profits would increase by $27,200." The Other Percy Five Divisions Division Total $1,665,000 $100,100 $1,765,100 Sales Cost of goods sold 977,400 76,900 1,054,300 Gross profit 687,600 23,200 710,800 Operating expenses 528,700 50,400 579,100 $158,900 $(27,200) $131,700 Net income In the Percy Division, cost of goods sold is $60,000 variable and $16,900 fixed, and operating expenses are $30,800 variable and $19,600 fixed. None of the Percy Division's fixed costs will be eliminated if the division is discontinued. Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your answer. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts