Question: Net Pay Calculation Example - Quebec Judy Jo works for the Kalish Manufacturing Company in St . Jean, Qu bec . Judy earns $ 2

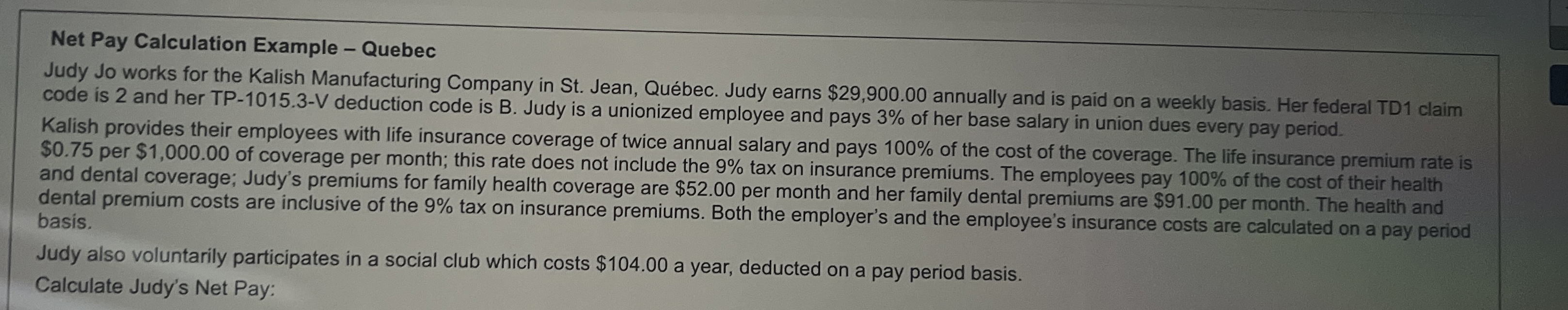

Net Pay Calculation Example Quebec

Judy Jo works for the Kalish Manufacturing Company in St Jean, Qubec Judy earns $ annually and is paid on a weekly basis. Her federal TD claim code is and her TPV deduction code is B Judy is a unionized employee and pays of her base salary in union dues every pay period.

Kalish provides their employees with life insurance coverage of twice annual salary and pays of the cost of the coverage. The life insurance premium rate is $ per $ of coverage per month; this rate does not include the tax on insurance premiums. The employees pay of the cost of their health and dental coverage; Judy's premiums for family health coverage are $ per month and her family dental premiums are $ per month. The health and dental premium costs are inclusive of the tax on insurance premiums. Both the employer's and the employee's insurance costs are calculated on a pay period basis.

Judy also voluntarily participates in a social club which costs $ a year, deducted on a pay period basis. Calculate Judy's Net Pay:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock