Question: Net Present Cost Question (a) A mining company is deciding whether to build a road or a railway to a new minesite. The road will

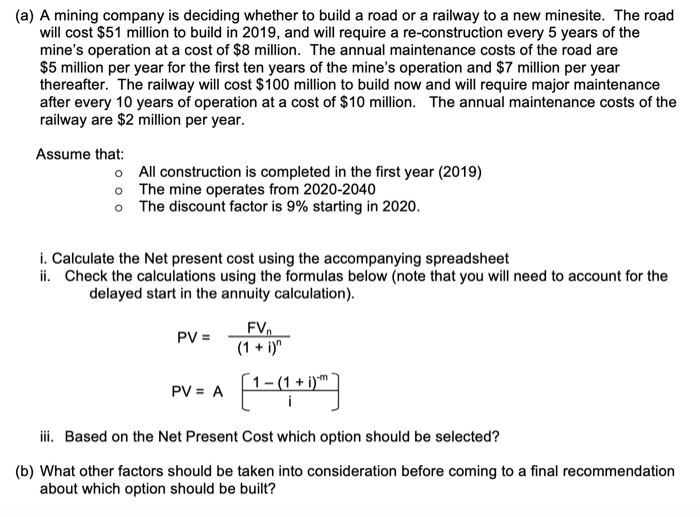

(a) A mining company is deciding whether to build a road or a railway to a new minesite. The road will cost $51 million to build in 2019, and will require a re-construction every 5 years of the mine's operation at a cost of $8 million. The annual maintenance costs of the road are $5 million per year for the first ten years of the mine's operation and $7 million per year thereafter. The railway will cost $100 million to build now and will require major maintenance after every 10 years of operation at a cost of $10 million. The annual maintenance costs of the railway are $2 million per year. Assume that: o All construction is completed in the first year (2019) o The mine operates from 2020-2040 o The discount factor is 9% starting in 2020. i. Calculate the Net present cost using the accompanying spreadsheet ii. Check the calculations using the formulas below (note that you will need to account for the delayed start in the annuity calculation) ili Based on the Net Present Cost which option should be selected? (b) What other factors should be taken into consideration before coming to a final recommendation about which option should be built

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts