Question: NET PRESENT VALUE 1 Net Present Value Method for a Service Company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $45,000

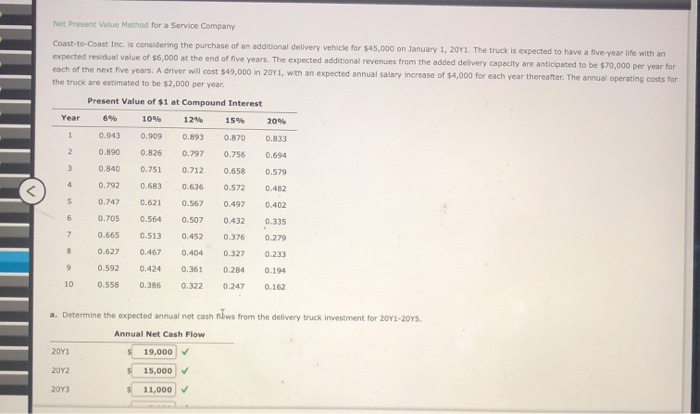

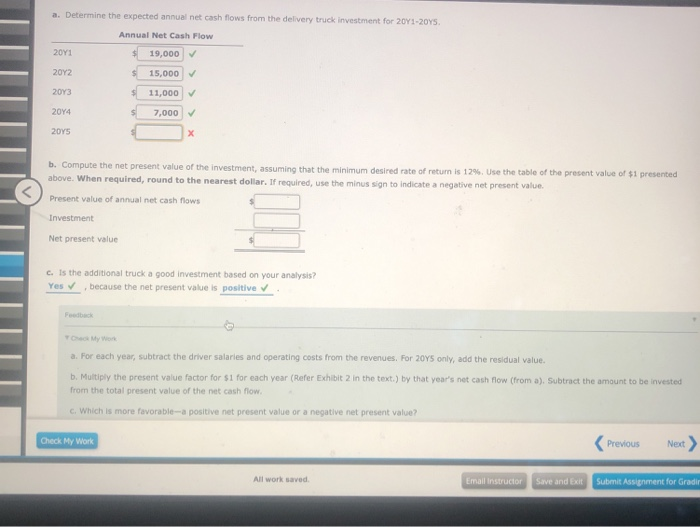

1 Net Present Value Method for a Service Company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $45,000 on January 1, 2011. The truck is expected to have a five-year life with an expected residual value of $6,000 at the end of five years. The expected additional revenues from the added delivery capacity are anticipated to be $70,000 per year for each of the next five years. A driver will cost $49,000 in 2011, with an expected annual salary increase of $4,000 for each year thereafter. The annual operating costs for the truck are estimated to be $2,000 per year. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 5 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Determine the expected annual net cash nws from the delivery truck investment for 2011-20YS. Annual Net Cash Flow 2011 19,000 2012 15,000 2013 11,000 a. Determine the expected annual net cash flows from the delivery truck investment for 2011-2015 Annual Net Cash Flow 2011 19,000 2012 15,000 2013 $ 11,000 2014 7,000 2015 b. Compute the net present value of the investment, assuming that the minimum desired rate of return is 12%. Use the table of the present value of $1 presented above. When required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value Present value of annual net cash flows Investment Net present value c. is the additional truck a good investment based on your analysis? Yes because the net present value is positive Feedback MyWort a. For each year, subtract the driver salaries and operating costs from the revenues. For 2015 only, add the residual value. b. Multiply the present value factor for $1 for each year (Refer Exhibit 2 in the text.) by that year's net cash flow (from a). Subtract the amount to be invested from the total present value of the net cash flow. C. Which is more favorable-a positive net present value or a negative net present value? Check My Work Previous Next > All work saved Email instructor Save and Exit Submit Assignment for Gradir

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts