Question: Net Present Value Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of

Net Present Value Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000. The company's required rate of return is 11 percent.

Required:

a. Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity.

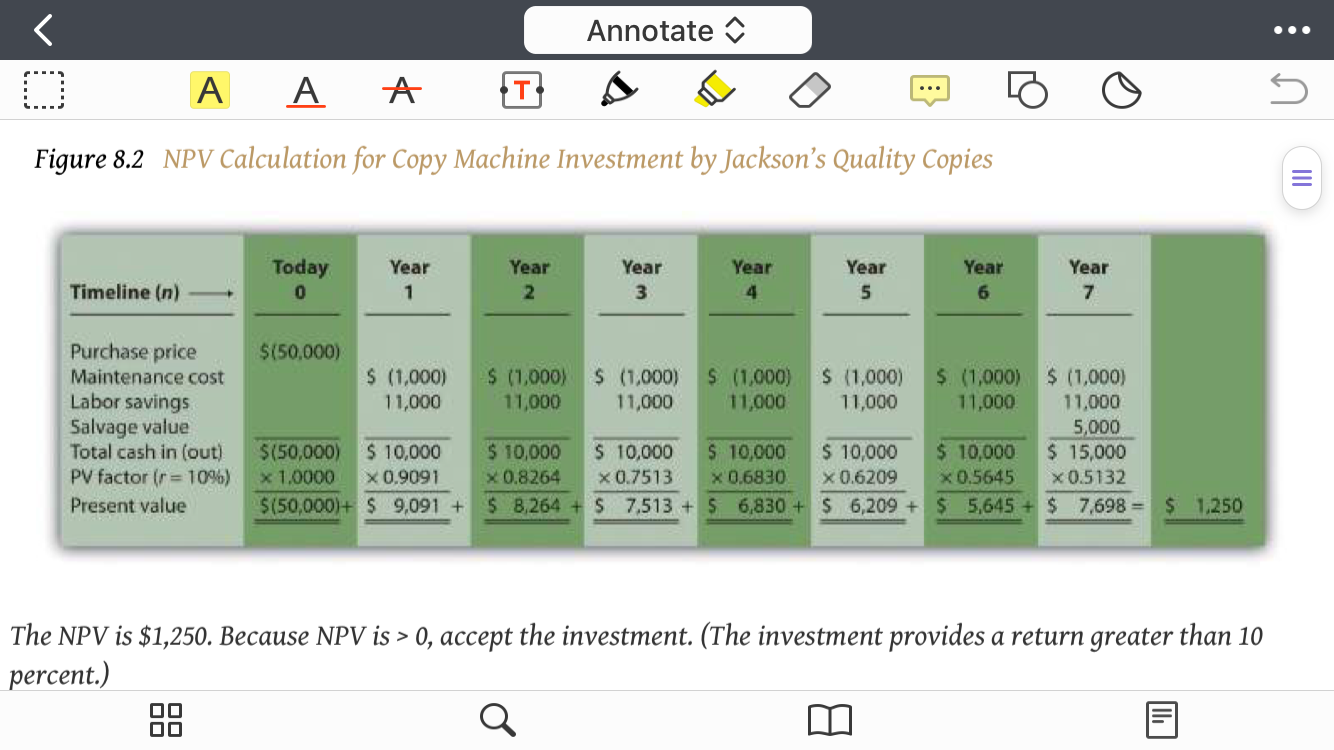

b. Find the net present value of this investment using the format presented in Figure 8.2.

c. Should the company purchase the blueprint machine? Explain.

The figure 8.2 is below

Annotate . . . AAA T [... 5 0 Figure 8.2 NPV Calculation for Copy Machine Investment by Jackson's Quality Copies E Today Year Year Year Year Year Year Year Timeline (n) 0 1 2 3 4 5 6 7 Purchase price $(50,000) Maintenance cost $ (1,000) $ (1,000) $ (1,000) $ (1,000) $ (1,000) $ (1,000) $ (1,000) Labor savings 11,000 11,000 11,000 11,000 11,000 11,000 11,000 Salvage value 5,000 Total cash in (out) $(50,000) $ 10,000 $ 10,000 $ 10,000 $ 10,000 $ 10,000 $ 10,000 $ 15,000 PV factor (r = 10%) x 1,0000 x 0,9091 x 0.8264 x 0.7513 * 0.6830 x 0.6209 x 0.5645 x 0.5132 Present value $ (50,000)+ $ 9,091 + $ 8,264 + $ 7,513 + $ 6,830 + $ 6,209 + $ 5,645 + $ 7,698 = $ 1,250 The NPV is $1,250. Because NPV is > 0, accept the investment. (The investment provides a return greater than 10 percent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts