Question: Net Present Value Analysis Champion Company is considering a contract that would require an expansion of its food processing capabilities. The contract covers five years.

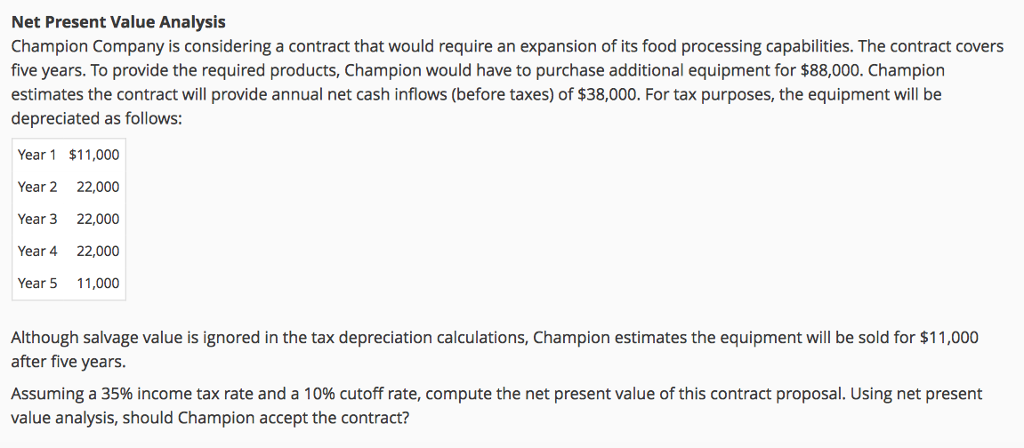

Net Present Value Analysis Champion Company is considering a contract that would require an expansion of its food processing capabilities. The contract covers five years. To provide the required products, Champion would have to purchase additional equipment for $88,000. Champion estimates the contract will provide annual net cash inflows (before taxes) of $38,000. For tax purposes, the equipment will be depreciated as follows:

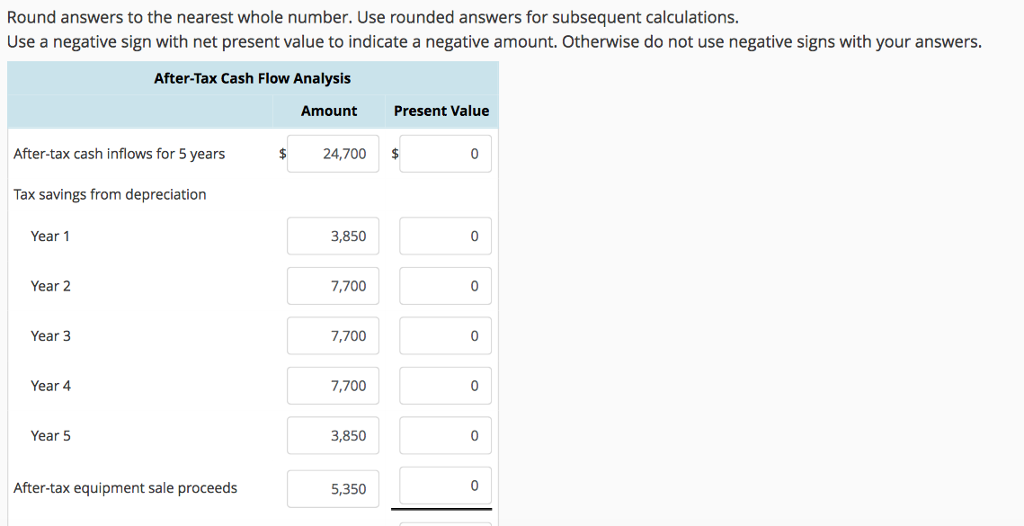

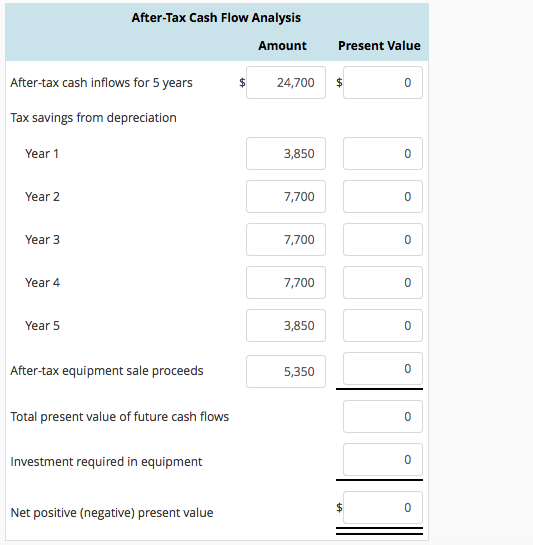

Net Present Value Analysis Champion Company is considering a contract that would require an expansion of its food processing capabilities. The contract covers five years. To provide the required products, Champion would have to purchase additional equipment for $88,000. Champion estimates the contract will provide annual net cash inflows (before taxes) of $38,000. For tax purposes, the equipment will be depreciated as follows: Year 1 $11,000 Year 2 22,000 Year 3 22,000 Year 4 22,000 Year 5 11,000 Although salvage value is ignored in the tax depreciation calculations, Champion estimates the equipment will be sold for $11,000 after five years. Assuming a 35% income tax rate and a 10% cutoff rate, compute the net present value o this contract proposal. Using net present value analysis, should Champion accept the contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts