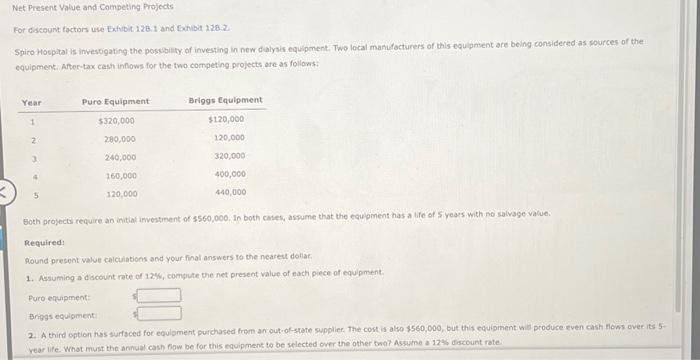

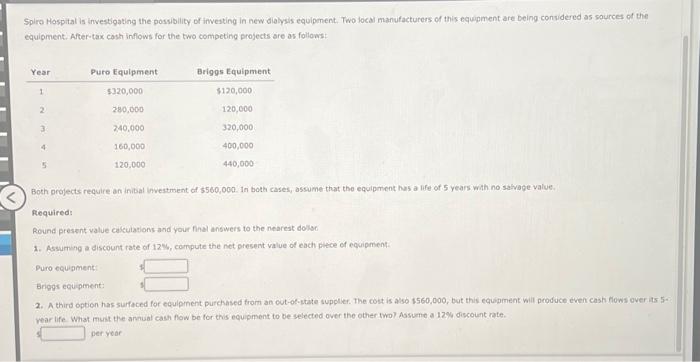

Question: Net Present Value and Competing Projects For discount factors use Exhibit 12B.1 and Exhibit 12B.2. Spiro Hospital is investigating the possibility of investing in new

Net Presens Value and Competing Projects For Gscount factors use Exhibit 128.1 and Gahibit 128.2 . Spiro Hospital is investigating the posebility of investing in new diblysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash infows for the two competing projects are as follows: Both proyects require an initial imvestment of \\( \\$ 560,000 \\). In both cases, aspume that the equpment has a life of 5 years with no salvage value. Required: Round present value calculations and your final answers to the nearest doliat. 1. Nssuming a discount rate of \12, compute the net present value of each piece of equipment. Puro equipment: Brigas equigment: 2. A thind option has surfaced for equioment purchased from an out-of-stote supplies. The cont is also \\( \\$ 560,000 \\), but this equipment will produce even cash fiows over its 5 . vear life. Whot must the annual cash fow be for this equipment to be selected over the other twat Assume a 12 th ciscount rate. Spliro Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equapment are being consudered as sources of the equipment: After-tax cosh inflows for the two competing projects are as follows: Both projects require an inibal investment of \\( \\$ 560,000 \\). in both cases, assume that the equipment has a life of 5 years wath no saivage value Required: Round present value calculations and your final answers to the nearest dollof 1. Assuming a discount tate of \12, compute the net present value of cach plece of equipment. Puro equigment: Briggs equipment: 2. A third option has surfaced for equipment purchased from an cut-0k-state supplier. The cost is also 1560,000 , but this equipment will produce even cash flows over its 5 vear life What must the amual cash fow be for this equipment to be selected over the other twol Assume a \12 discount rate. peryear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts