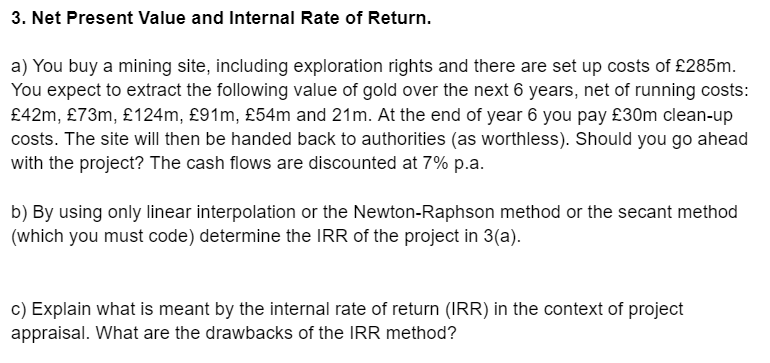

Question: Net Present Value and Internal Rate of Return. a ) You buy a mining site, including exploration rights and there are set up costs of

Net Present Value and Internal Rate of Return.

a You buy a mining site, including exploration rights and there are set up costs of You expect to extract the following value of gold over the next years, net of running costs: and At the end of year you pay cleanup costs. The site will then be handed back to authorities as worthless Should you go ahead with the project? The cash flows are discounted at pa

b By using only linear interpolation or the NewtonRaphson method or the secant method which you must code determine the IRR of the project in a

c Explain what is meant by the internal rate of return IRR in the context of project appraisal. What are the drawbacks of the IRR method?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock