Question: Net Present Value, Basic Concepts For discount factors use Exhibit 12B.1. Wise Company is considering an investment that requires an outlay of $600,000 and promises

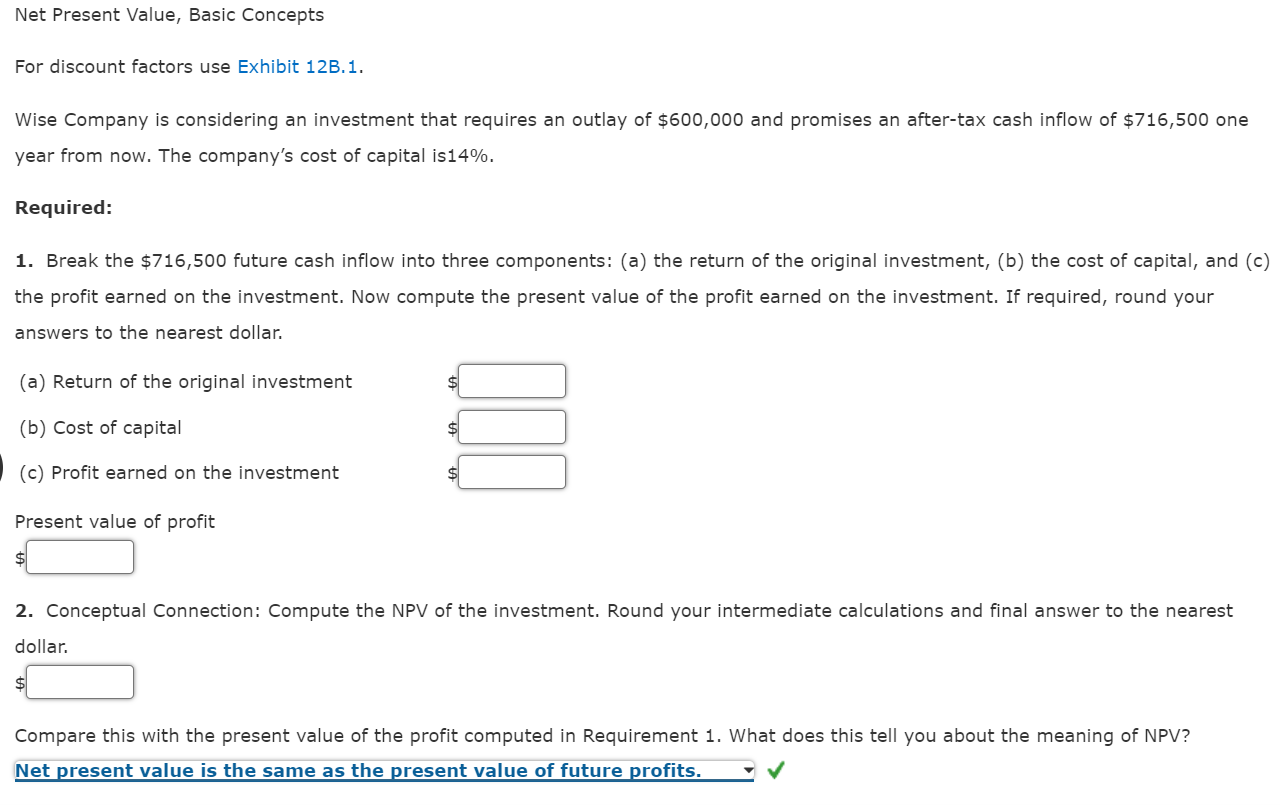

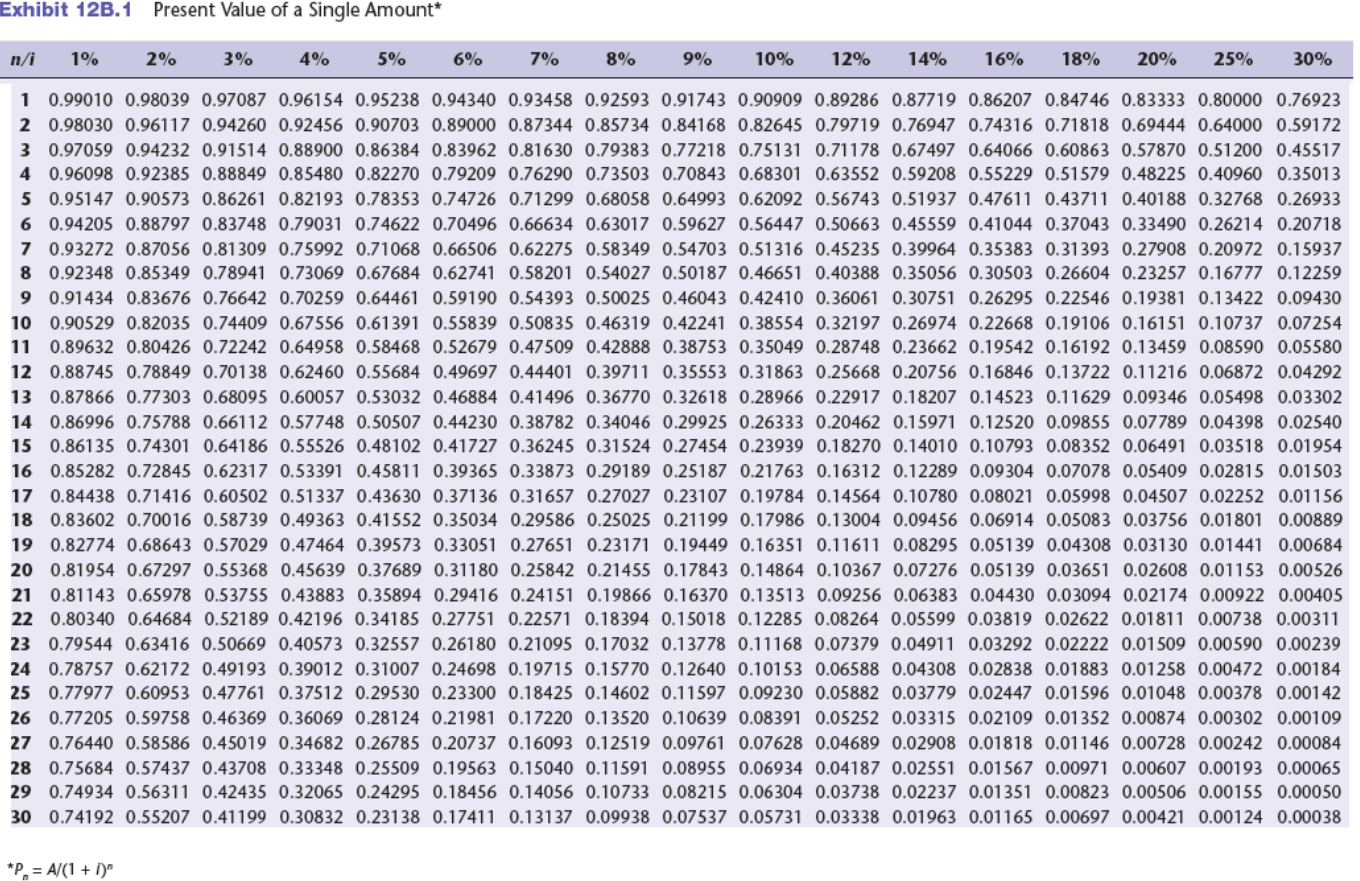

Net Present Value, Basic Concepts For discount factors use Exhibit 12B.1. Wise Company is considering an investment that requires an outlay of $600,000 and promises an after-tax cash inflow of $716,500 one year from now. The company's cost of capital is 14%. Required: 1. Break the $716,500 future cash inflow into three components: (a) the return of the original investment, (b) the cost of capital, and (c) the profit earned on the investment. Now compute the present value of the profit earned on the investment. If required, round your answers to the nearest dollar. Present value of profit 2. Conceptual Connection: Compute the NPV of the investment. Round your intermediate calculations and final answer to the nearest dollar. Pn=A/(1+1)n Net Present Value, Basic Concepts For discount factors use Exhibit 12B.1. Wise Company is considering an investment that requires an outlay of $600,000 and promises an after-tax cash inflow of $716,500 one year from now. The company's cost of capital is 14%. Required: 1. Break the $716,500 future cash inflow into three components: (a) the return of the original investment, (b) the cost of capital, and (c) the profit earned on the investment. Now compute the present value of the profit earned on the investment. If required, round your answers to the nearest dollar. Present value of profit 2. Conceptual Connection: Compute the NPV of the investment. Round your intermediate calculations and final answer to the nearest dollar. Pn=A/(1+1)n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts