Question: Net Present Value Calculation Assignment You are working for Scotland Memorial Hospital and have been asked to help senior administration make a decision regarding the

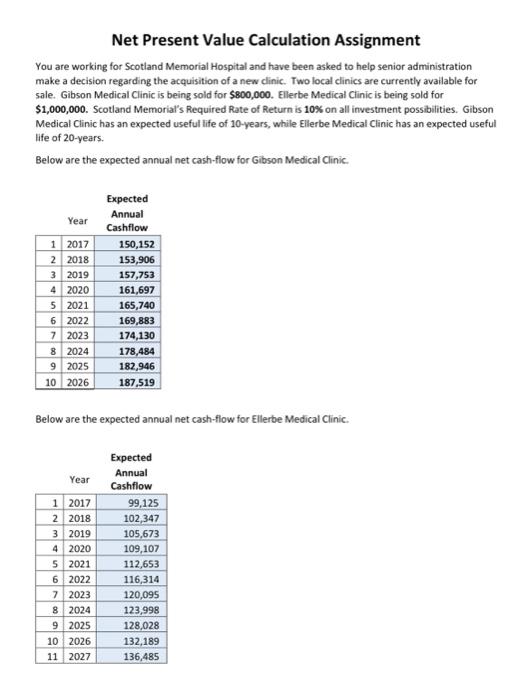

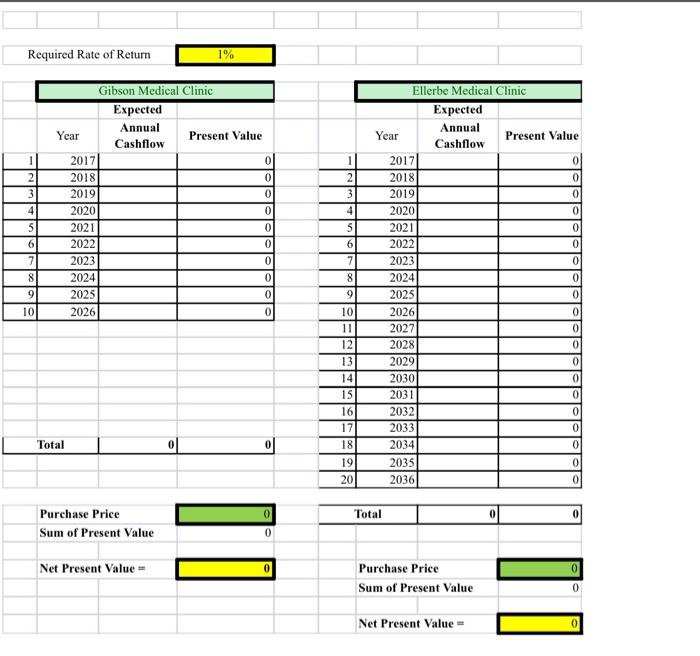

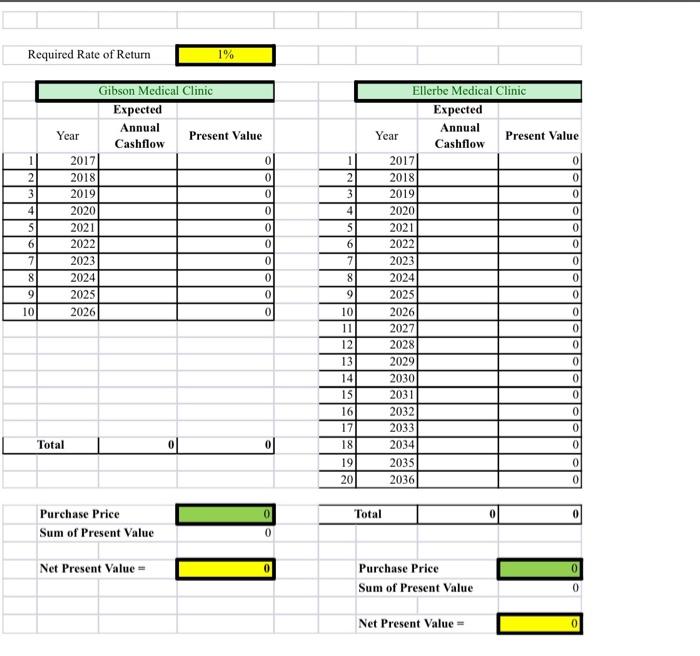

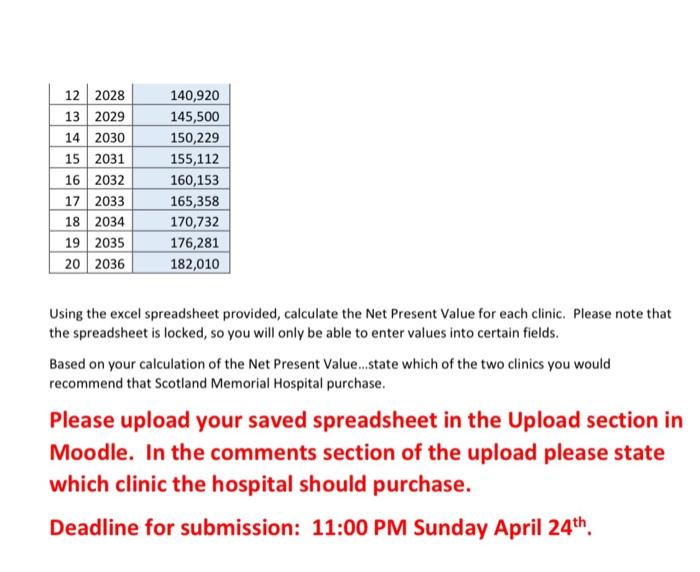

Net Present Value Calculation Assignment You are working for Scotland Memorial Hospital and have been asked to help senior administration make a decision regarding the acquisition of a new clinic. Two local clinics are currently available for sale. Gibson Medical Clinic is being sold for $800,000. Ellerbe Medical Clinic is being sold for $1,000,000. Scotland Memorial's Required Rate of Return is 10% on all investment possibilities. Gibson Medical Clinic has an expected useful life of 10-years, while Ellerbe Medical Clinic has an expected useful life of 20-years. Below are the expected annual net cash-flow for Gibson Medical Clinic Year 1 2017 2 2018 3 2019 4 2020 5 2021 6 2022 7 2023 8 2024 9 2025 10 2026 Expected Annual Cashflow 150,152 153,906 157,753 161,697 165,740 169,883 174,130 178,484 182,946 187,519 Below are the expected annual net cash-flow for Ellerbe Medical Clinic Year 1 2017 2 2018 3 2019 4 2020 5 2021 6 2022 7 2023 8 2024 9 2025 10 2026 11 2027 Expected Annual Cashflow 99,125 102,347 105,673 109,107 112,653 116,314 120,095 123,998 128,028 132,189 136,485 Required Rate of Return 1% 1 2 3 Gibson Medical Clinic Expected Annual Year Present Value Cashflow 2017 0 2018 0 2019 0 2020 0 2021 0 2022 0 2023 0 2024 0 2025 0 2026 0 2 3 4 5 4 5 6 6 7 7 8 8 Ellerbe Medical Clinic Expected Annual Year Present Value Cashflow 2017 0 2018 0 2019 0 2020 0 2021 0 2022 0 2023 0 2024 0 2025 0 2026 0 2027 0 2028 0 2029 0 2030 0 2031 0 2032 0 2033 2034 0 2035 0 2036 0 9 9 10 10 11 12 131 14 15 16 17 Total 0 181 191 20 Total Purchase Price Sum of Present Value Net Present Value Purchase Price Sum of Present Value 0 Net Present Value Required Rate of Return 1% 1 2 3 Gibson Medical Clinic Expected Annual Year Present Value Cashflow 2017 0 2018 0 2019 0 2020 0 2021 0 2022 0 2023 0 2024 0 2025 0 2026 0 2 3 4 5 4 5 6 6 7 7 8 8 Ellerbe Medical Clinic Expected Annual Year Present Value Cashflow 2017 0 2018 0 2019 0 2020 0 2021 0 2022 0 2023 0 2024 0 2025 0 2026 0 2027 0 2028 0 2029 0 2030 0 2031 0 2032 0 2033 0 2034 0 2035 0 2036 0 9 9 10 10 11 12 131 14 15 16 17 Total 18 191 20 Total Purchase Price Sum of Present Value Net Present Value = Purchase Price Sum of Present Value 0 Net Present Value 12 2028 13 2029 14 2030 15 2031 16 2032 17 2033 18 2034 19 2035 20 2036 140,920 145,500 150,229 155,112 160,153 165,358 170,732 176,281 182,010 Using the excel spreadsheet provided, calculate the Net Present Value for each clinic. Please note that the spreadsheet is locked, so you will only be able to enter values into certain fields. Based on your calculation of the Net Present Value...state which of the two clinics you would recommend that Scotland Memorial Hospital purchase. Please upload your saved spreadsheet in the Upload section in Moodle. In the comments section of the upload please state which clinic the hospital should purchase. Deadline for submission: 11:00 PM Sunday April 24th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts