Question: Net Present Value Method and Internal Rate of Return Method Buckeye Healthcare Corp. is proposing to spend $97,360 on a(an) project that has estimated net

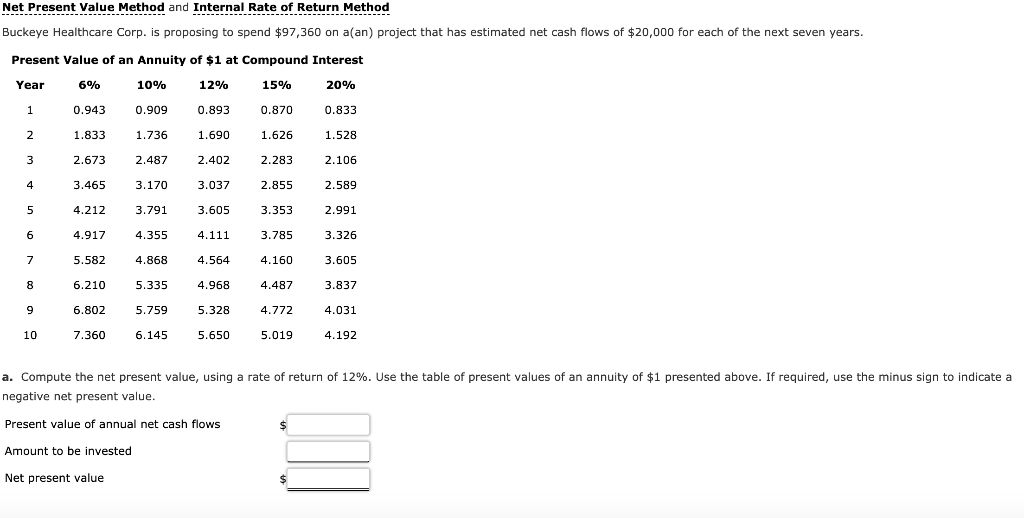

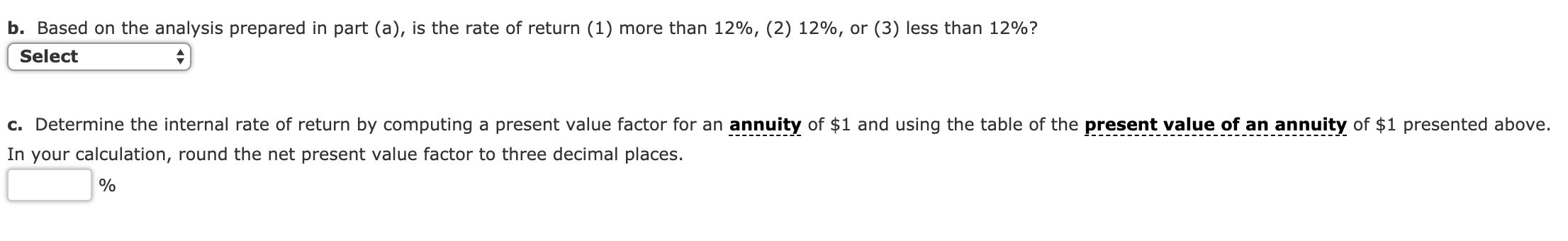

Net Present Value Method and Internal Rate of Return Method Buckeye Healthcare Corp. is proposing to spend $97,360 on a(an) project that has estimated net cash flows of $20,000 for each of the next seven years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 15% 20% 0.943 12% 0.893 1.690 0.870 0.833 0.909 1.736 2.487 1.833 1.626 1.528 2.673 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 3.791 3.605 3.353 2.991 4.355 4.868 4.111 4.564 3.785 4.160 3.326 3.605 4.212 4.917 7 5.582 6.210 6 .802 107.360 9 5.335 5.759 6.145 4.968 4.487 3.837 5.328 4.772 4.031 5.6505.0194.192 a. Compute the net present value, using a rate of return of 12%. Use the table of present values of an annuity of $1 presented above. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows Amount to be invested Net present value b. Based on the analysis prepared in part (a), is the rate of return (1) more than 12%, (2) 12%, or (3) less than 12%? Select c. Determine the internal rate of return by computing a present value factor for an annuity of $1 and using the table of the present value of an annuity of $1 presented above. In your calculation, round the net present value factor to three decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts