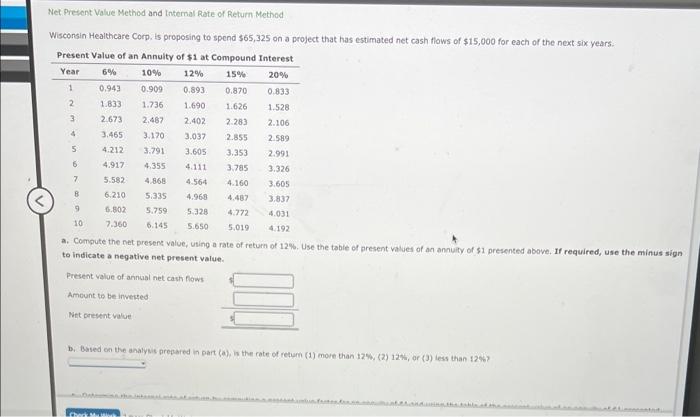

Question: Net Present Value Method and Internal Rate of Return Method Wisconsin Healthcare Corp, is proposing to spend $65,325 on a project that has estimated net

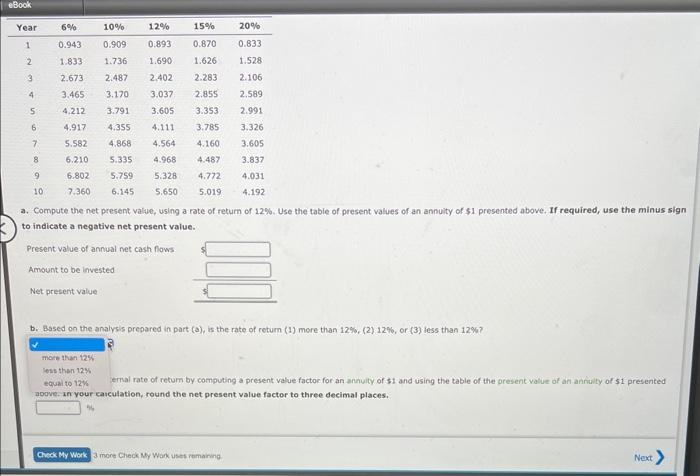

Net Present Value Method and Internal Rate of Return Method Wisconsin Healthcare Corp, is proposing to spend $65,325 on a project that has estimated net cash flows of $15,000 for each of the next six years: Present Value of an Annultw of t1 at rammanad vue.t.s. a. Compute the net presene value, using a rate of return of 12%. Use the tabie of present values of an annuity of s1 presented above, If required, use the minus sign to indicate a negative net present value. b. Based co the analysis prepared in part (a), is the rate of retum (1) move than 12\%, (2) 12\%, or (3) less than 12\%,? a. Compute the net present value, using a rate of return of 12%. Use the table of present values of an annuity of $1 presented above, If required, use the minus to indicate a negative net present value. b. Based on the analysis prepared in part (a), is the rate of return (1) more than 12%, (2) 12\%, or (3) less than 12% ? more than 12\% loss then 12% equal to 12% emal rate of retum by computing a present value factor for an annuity of $1 and using the table of the present value of an annulty of $1 presented aodve. in your casculation, round the net present value factor to three decimal places. 3 more Check My Wank uses remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts