Question: Net Present Value Method and Present Value Index Diamond and Turf inc. is considering an investment in one of two machines. The sewing machine will

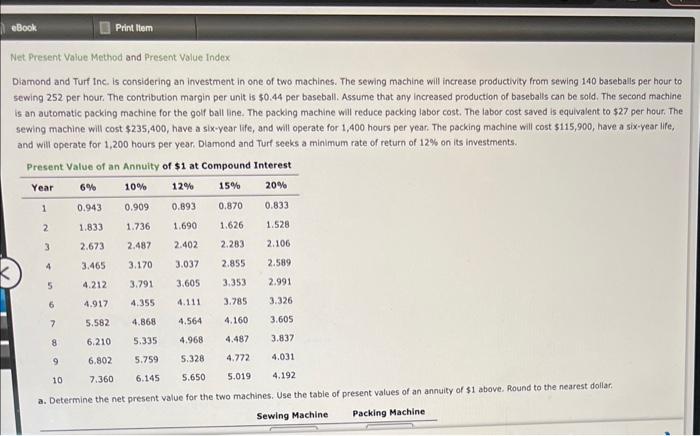

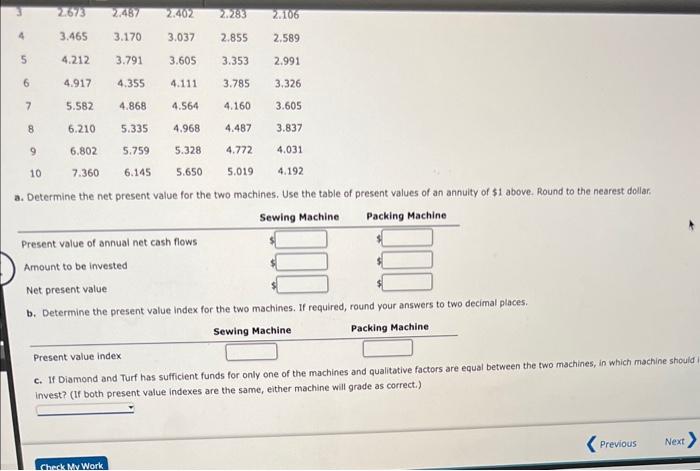

Net Present Value Method and Present Value Index Diamond and Turf inc. is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 140 baseballs per hour to sewing 252 per hour. The contribution margin per unit is $0.44 per baseball. Assume that any increased production of basebalis can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $27 per hour. The sewing machine will cost $235,400, have a slix-year life, and will operate for 1,400 hours per year. The packing machine will cost $115,900, have a six-year life, and will operate for 1,200 hours per year, Dlamond and Turf sceks a minimum rate of return of 12% on its investments. c. If Diamond and Turf has sufficient funds for only one of the machines and qualitative factors are equar between the two machines, in which machine snould invest? (If both present value indexes are the same, either machine will grade as correct.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts