Question: Net present value method Consider the case of Krause Corp.: Krause Corp. is evaluating a proposed capital budgeting project that will require an initial investment

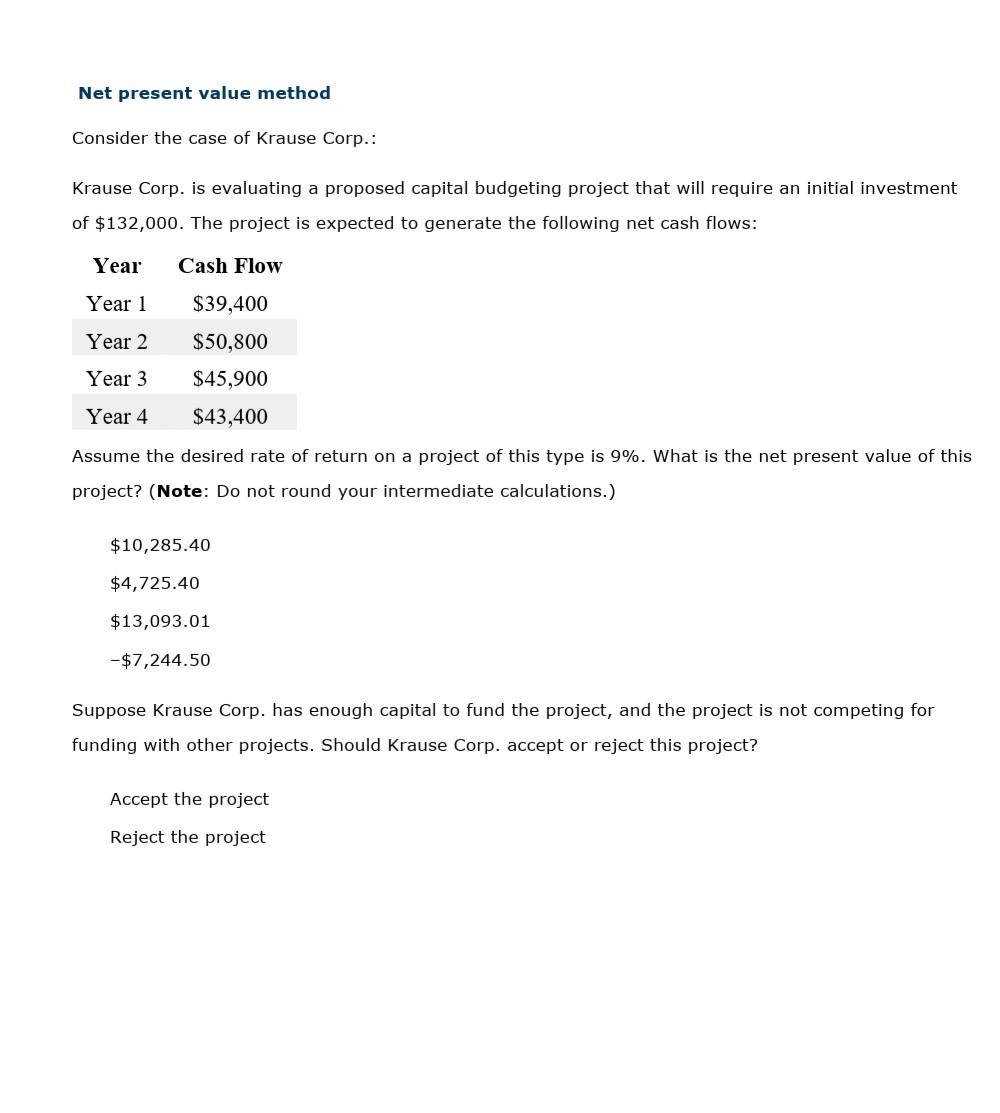

Net present value method Consider the case of Krause Corp.: Krause Corp. is evaluating a proposed capital budgeting project that will require an initial investment of $132,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $39,400 $50,800 Year 2 Year 3 $45,900 Year 4 $43,400 Assume the desired rate of return on a project of this type is 9%. What is the net present value of this project? (Note: Do not round your intermediate calculations.) $10,285.40 $4,725.40 $13,093.01 -$7,244.50 Suppose Krause Corp. has enough capital to fund the project, and the project is not competing for funding with other projects. Should Krause Corp. accept or reject this project? Accept the project Reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts