Question: Net Present Value Method for a Service Company Express in consider the purchase of an adonal delivery vehicle for $32,000 on January 1, 2011. The

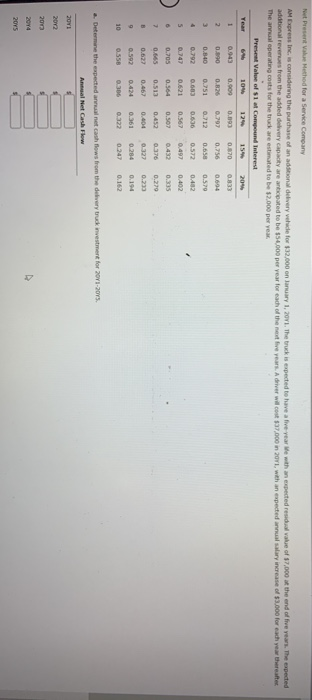

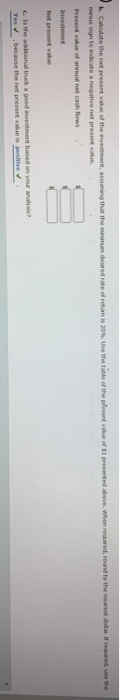

Net Present Value Method for a Service Company Express in consider the purchase of an adonal delivery vehicle for $32,000 on January 1, 2011. The truck is expected to have a five year Me with an expected residual value of $7.000 at the end of five years. The expected dational revenues from the added every capacarean t ed to be $50,000 per year for each of the next five years. A driver will cost $37.000 in 2011, with an expected annual salary increase of $3.000 for each year thereafter The annual operating costs for the truckare estimated to be $2.000 per year Present Value of Si at Compound Interest Year 10% 12% 15% 0.756 0.694 0.840 0.826 0.751 0.683 0.658 0.579 0.572 0.621 0.712 0.636 0.567 0.507 0.452 0.705 0.513 0.665 0.622 0.592 0.558 0.45) 0.44 0.361 0.322 0.284 0.247 0.306 0.162 .. Determine the expected an n et cash flows from the delivery truck investment for 2011-2015 al Net Cash Flow e d, use the b. Calculate the net present value of the investment, assuming that the minimum desired rate of return is 20%. Use the table of the present value of si presented above. When recured, round to the nearest dollar i r minussion to wcate a negative net present value Present value of net cash flows Investment het present value Is the a Yes n al tud a good westment based on your analyses? , because the net present value is positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts