Question: Net Present Value Method, Internal Rate of Return Method, and Analysis The management of Advanced Alternative Power Inc. is considering two capital investment projects. The

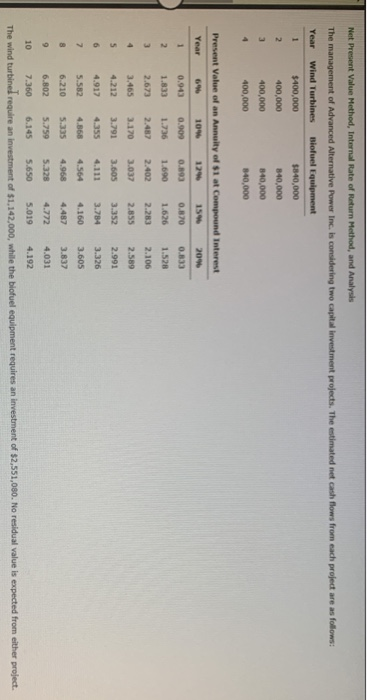

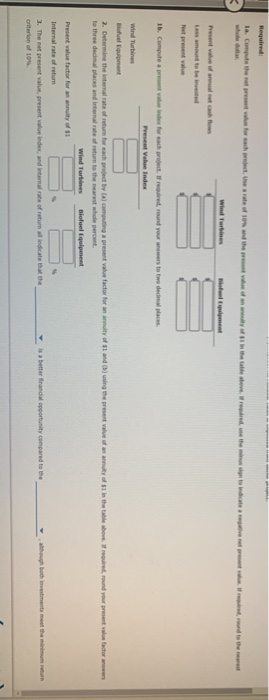

Net Present Value Method, Internal Rate of Return Method, and Analysis The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Year Wind Turbines Biofuel Equipment $400,000 $840,000 2 400,000 840,000 3 400,000 840,000 4 400,000 840,000 4 Present Value of an Annuity of $1 at Compound Interest Year 101 154 209 0.943 0.900 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 3.465 3.120 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 3.784 3.326 7 5.582 4.366 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 The wind turbine require an investment of $1,142,000, while the biofuel equipment requires an investment of $2,551,080. No residual value is expected from either project. Hequired: Wind Turbines Less amount to be invited ib. Computea vender for each project required, round your answers to two decades Present Value Index Wind Turbines Bichelin 2. Determine the internal rate of return for each project by (a) coming a present value factor for any of sand (1) using the present value of an annuity of 1 in the table bort froid, round your present at factor to three decimal places and internal rate of return to the nearest whole percent Wind Turbines Biofuel Equipment Present value factor for an annuity of 11 Internal rate of retum 4 3. The net present value present value Index, and intamate of return al indicate that the is a better financial opportunity compared to the though both investments meet the return criterion of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts