Question: Net Present Value Method, Present Value Index, and Analysis First United Bank Inc. is evaluating three capital investment projects using the net present value method

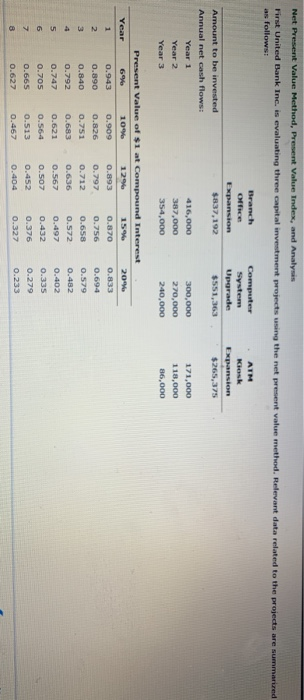

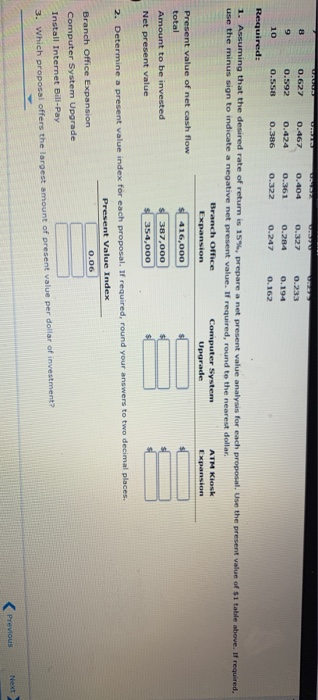

Net Present Value Method, Present Value Index, and Analysis First United Bank Inc. is evaluating three capital investment projects using the net present value method Relevant data related to the projects are summarized as follows: Branch System Kiosk Expansion Upgrade Expansion Amount to be invested $837,192 $265,375 Annual net cash flows: 416,000 300,000 171,000 Year 2 387,000 270,000 118,000 Year 3 354,000 240,000 86,000 Present Value of $1 at Compound Interest 6 % 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 10 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.327 0.627 0.592 0.558 0.467 0.424 0.386 0.404 0.361 0.322 0.233 0.194 0.162 0.247 Required: 1. Assuming that the desired rate of retum is 15%, prepare a ne present value analysis for each proposal. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar Branch Office Computer System AIM Kiosk Expansion Expansion Present value of net cash flow 416,000 total Amount to be invested $307,000 Net present value $ 354,000 2. Determine a present value index for each proposal. If required, round your answers to two decimal places. Present Value Index Branch Office Expansion Computer System Upgrade Install Internet Bill Pay 3. Which proposal offers the largest amount of present value per dollar of investment Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts