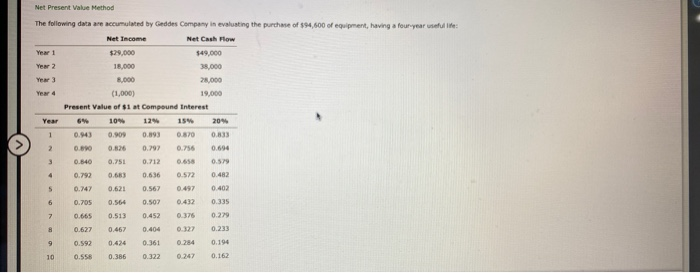

Question: Net Present Value Method Year 204 The following data are accumulated by Geddes Company in evaluating the purchase of $94,500 of equipment, having a four

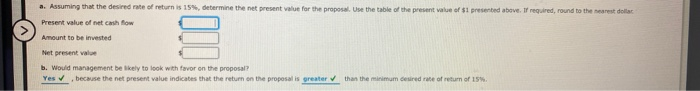

Net Present Value Method Year 204 The following data are accumulated by Geddes Company in evaluating the purchase of $94,500 of equipment, having a four year useful Net Income Net Cash Flow $29.000 $49,000 18,000 38,000 .000 28.000 (1,000) 19,000 Present Value of $1 at Compound Interest 6% 10% 12% 0.909 0.893 0.833 0.80 0.626 0.792 0.840 0.751 0.212 0658 0.792 0.663 0.636 0.482 0.747 0.621 0.567 0.705 0.564 0.507 0.335 0.513 0.452 0.375 0.279 0.627 0.467 0327 0213 0.592 0.361 0.284 0.194 10 0.558 0.386 0322 0.247 0.162 0404 .. Assuming that the desired to return is termine the present for the proposal Use the table the present wave of presented above required, round to the rest Present value of net cash flow Amount to be invested Net present value b. would management be kely to look with or on the proposal Yes because the net present value indicates that the return on the proposals greater than them e of return of 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts