Question: Net Present Value (NPV) analysis is a financial evaluation method used in project management to assess the profitability and viability of investment projects. NPV

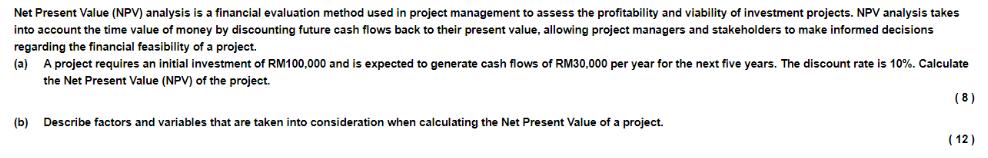

Net Present Value (NPV) analysis is a financial evaluation method used in project management to assess the profitability and viability of investment projects. NPV analysis takes into account the time value of money by discounting future cash flows back to their present value, allowing project managers and stakeholders to make informed decisions regarding the financial feasibility of a project. (a) A project requires an initial investment of RM100,000 and is expected to generate cash flows of RM30,000 per year for the next five years. The discount rate is 10%. Calculate the Net Present Value (NPV) of the project. (b) Describe factors and variables that are taken into consideration when calculating the Net Present Value of a project. (8) (12)

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

a Calculating Net Present Value NPV The formula to calculate NPV is NPV sumt0n CFt1rt Initial Investment Where CFt Cash flow in year t r Discount rate ... View full answer

Get step-by-step solutions from verified subject matter experts