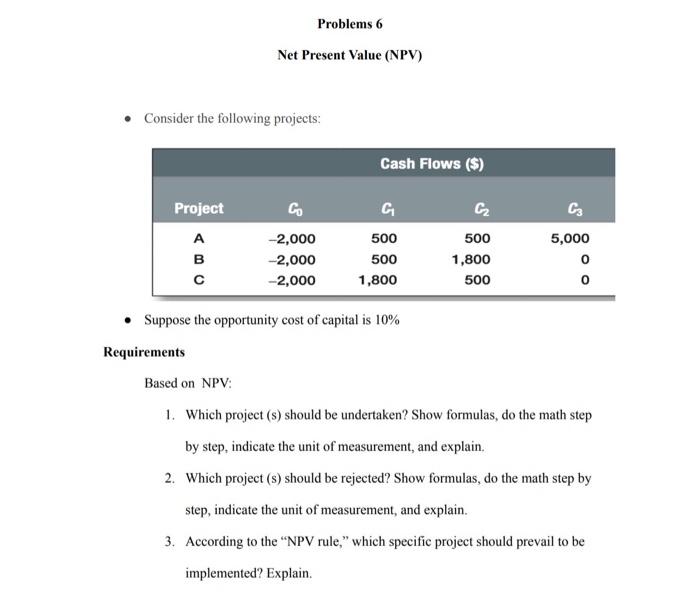

Question: Net Present Value please I need this solve, show every step as required wirh this formulas - Consider the following projects: - Suppose the opportunity

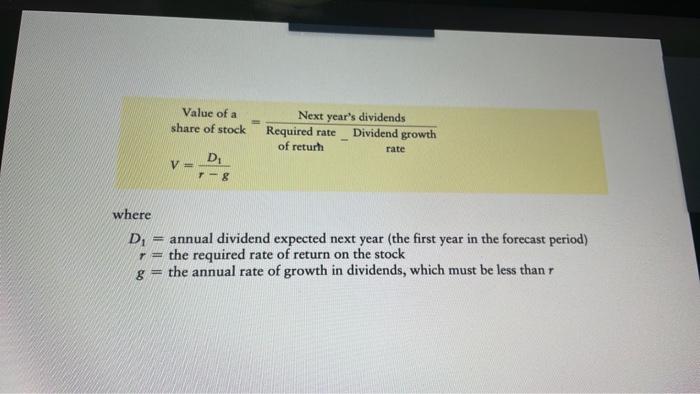

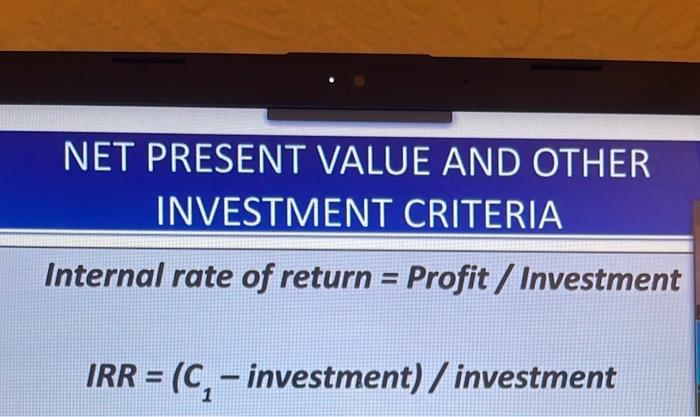

- Consider the following projects: - Suppose the opportunity cost of capital is 10% Qequirements Based on NPV: 1. Which project (s) should be undertaken? Show formulas, do the math step by step, indicate the unit of measurement, and explain. 2. Which project (s) should be rejected? Show formulas, do the math step by step, indicate the unit of measurement, and explain. 3. According to the "NPV rule," which specific project should prevail to be implemented? Explain. where D1rg=annualdividendexpectednextyear(thefirstyearintheforecastperiod)=therequiredrateofreturnonthestock=theannualrateofgrowthindividends,whichmustbelessthanr NPV=PV( cost )PV (benefits) =0 NET PRESENT VALUE AND OTHER INVESTMENT CRITERIA Internal rate of return = Profit / Investment IRR=(C1 investment )/ investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts