Question: Net Present Value problem. Please help to solve completely and answer questions 1-5. Chart attached below. FINA 440 Net Present Value Salamar Replacement The Salazar

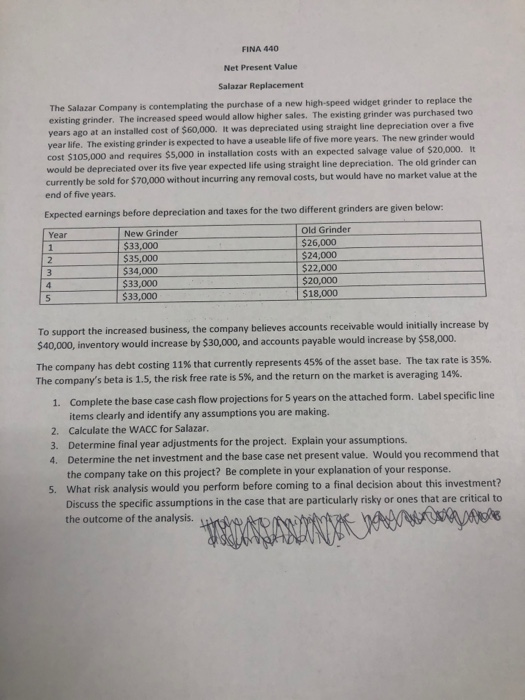

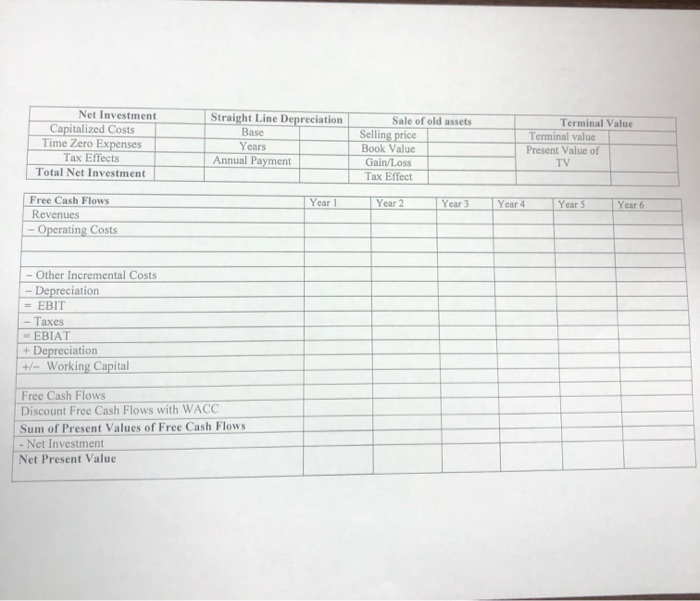

FINA 440 Net Present Value Salamar Replacement The Salazar Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The increased speed would allow higher sales. The existing grinder was purchased two years ago at an installed cost of $60,000. It was depreciated using straight line depreciation over a five year Me. The existing grinder is expected to have a useable life of five more years. The new grinder would cost $105,000 and requires $5,000 in installation costs with an expected salvage value of $20,000. It would be depreciated over its five year expected life using straight line depreciation. The old grinder can currently be sold for $70,000 without incurring any removal costs, but would have no market value at the end of five years. Expected earnings before depreciation and taxes for the two different grinders are given below. Year New Grinder $33,000 $35,000 $34,000 $33,000 $33,000 Old Grinder $26.000 $24,000 $22.000 $20,000 $18,000 To support the increased business, the company believes accounts receivable would initially increase by $40,000, inventory would increase by $30,000, and accounts payable would increase by $58,000 The company has debt costing 11% that currently represents 45% of the asset base. The tax rate is 35%. The company's beta is 1.5, the risk free rate is 5%, and the return on the market is averaging 14%. 1. Complete the base case cash flow projections for 5 years on the attached form. Label specific line items clearly and identify any assumptions you are making. 2. Calculate the WACC for Salazar. 3. Determine final year adjustments for the project. Explain your assumptions. 4. Determine the net investment and the base case net present value. Would you recommend that the company take on this project? Be complete in your explanation of your response. 5. What risk analysis would you perform before coming to a final decision about this investment? Discuss the specific assumptions in the case that are particularly risky or ones that are critical to the outcome of the analysis wa Uwa ng Net Investment Capitalized Costs Time Zero Expenses Tax Effects Total Net Investment Straight Line Depreciation Base Years Annual Payment Sale of old assets Selling price Book Value Gain/Loss Tax Effect Terminal Value Terminal value Present Value of TV Year 2 Year 3 Year 4 Year 5 Year 6 Free Cash Flows Revenues - Operating Costs - Other Incremental Costs - Depreciation = EBIT - Taxes -EBIAT + Depreciation +/- Working Capital Free Cash Flows Discount Free Cash Flows with WACC Sum of Present Values of Free Cash Flows - Net Investment Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts