Question: Net Present Value - Solve and complete chart below. (Fill in blanks) FINA 440 Net Present Value TLC Yogurt TLC Yogurt has decided to capitalize

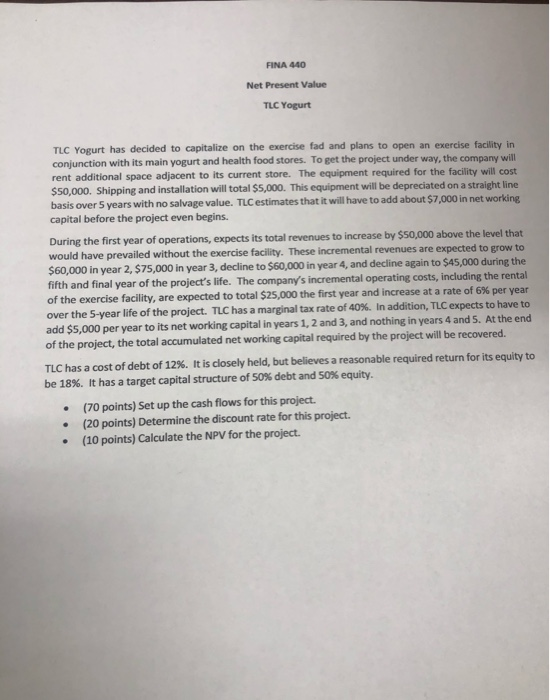

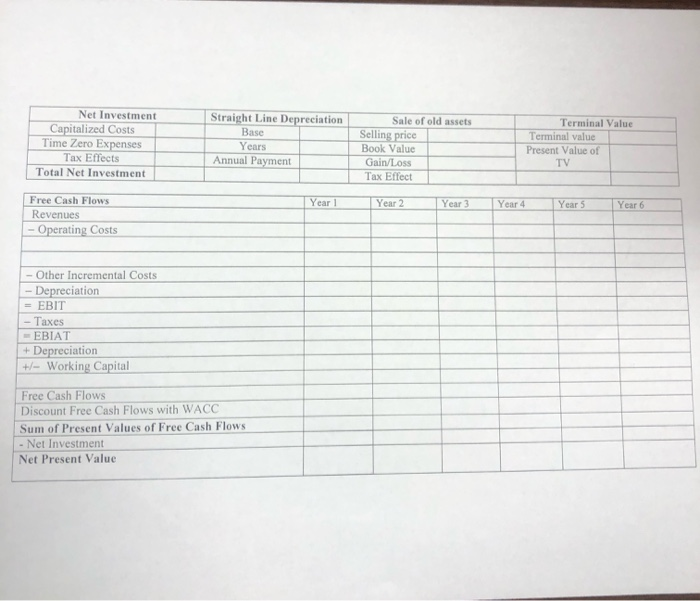

FINA 440 Net Present Value TLC Yogurt TLC Yogurt has decided to capitalize on the exercise fad and plans to open an exercise facility in conjunction with its main yogurt and health food stores. To get the project under way, the company will rent additional space adjacent to its current store. The equipment required for the facility will cost $50,000. Shipping and installation will total $5,000. This equipment will be depreciated on a straight line basis over 5 years with no salvage value. TLC estimates that it will have to add about $7,000 in net working capital before the project even begins. During the first year of operations, expects its total revenues to increase by $50,000 above the level that would have prevailed without the exercise facility. These incremental revenues are expected to grow to $60,000 in year 2, $75,000 in year 3, decline to $60,000 in year 4, and decline again to $45,000 during the fifth and final year of the project's life. The company's incremental operating costs, including the rental of the exercise facility, are expected to total $25,000 the first year and increase at a rate of 6 % per year over the 5-year life of the project. TLC has a marginal tax rate of 40%. In addition, TLC expects to have to add $5,000 per year to its net working capital in years 1, 2 and 3, and nothing in years 4 and 5. At the end of the project, the total accumulated net working capital required by the project will be recovered. TLC has a cost of debt of 12 %. It is closely held, but believes a reasonable required return for its equity to be 18 %. It has a target capital structure of 50 % debt and 50% equity. (70 points) Set up the cash flows for this project. (20 points) Determine the discount rate for this project. (10 points) Calculate the NPV for the project. Net Investment Capitalized Costs Time Zero Expenses Straight Line Depreciation Base Sale of old assets Terminal Value Selling price Terminal value Years Book Value Present Value of Annual Payment Tax Effects Gain/Loss TV Total Net Investment Effect Free Cash Flows Revenues Year Year 2 Year 4 Year 6 Year 3 Year 5 - Operating Costs - Other Incremental Costs - Depreciation =EBIT es -EBIAT +Depreciation + Working Capital Free Cash Flows Discount Free Cash Flows with WACC Sum of Present Values of Free Cash Flows Net Investment Net Present Value FINA 440 Net Present Value TLC Yogurt TLC Yogurt has decided to capitalize on the exercise fad and plans to open an exercise facility in conjunction with its main yogurt and health food stores. To get the project under way, the company will rent additional space adjacent to its current store. The equipment required for the facility will cost $50,000. Shipping and installation will total $5,000. This equipment will be depreciated on a straight line basis over 5 years with no salvage value. TLC estimates that it will have to add about $7,000 in net working capital before the project even begins. During the first year of operations, expects its total revenues to increase by $50,000 above the level that would have prevailed without the exercise facility. These incremental revenues are expected to grow to $60,000 in year 2, $75,000 in year 3, decline to $60,000 in year 4, and decline again to $45,000 during the fifth and final year of the project's life. The company's incremental operating costs, including the rental of the exercise facility, are expected to total $25,000 the first year and increase at a rate of 6 % per year over the 5-year life of the project. TLC has a marginal tax rate of 40%. In addition, TLC expects to have to add $5,000 per year to its net working capital in years 1, 2 and 3, and nothing in years 4 and 5. At the end of the project, the total accumulated net working capital required by the project will be recovered. TLC has a cost of debt of 12 %. It is closely held, but believes a reasonable required return for its equity to be 18 %. It has a target capital structure of 50 % debt and 50% equity. (70 points) Set up the cash flows for this project. (20 points) Determine the discount rate for this project. (10 points) Calculate the NPV for the project. Net Investment Capitalized Costs Time Zero Expenses Straight Line Depreciation Base Sale of old assets Terminal Value Selling price Terminal value Years Book Value Present Value of Annual Payment Tax Effects Gain/Loss TV Total Net Investment Effect Free Cash Flows Revenues Year Year 2 Year 4 Year 6 Year 3 Year 5 - Operating Costs - Other Incremental Costs - Depreciation =EBIT es -EBIAT +Depreciation + Working Capital Free Cash Flows Discount Free Cash Flows with WACC Sum of Present Values of Free Cash Flows Net Investment Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts