Question: Net Present Value - Unequal Lives Project 1 requires an original imvestment of $125,000. The project will yield cash fiows of $50,000 per yeat for

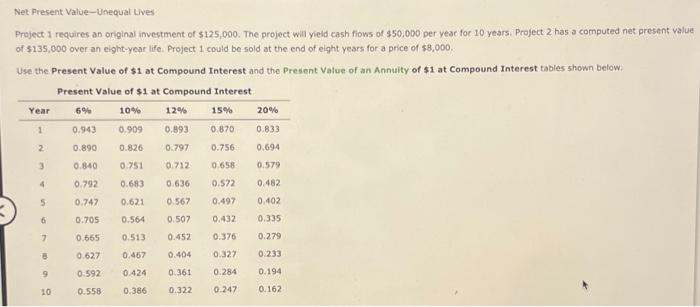

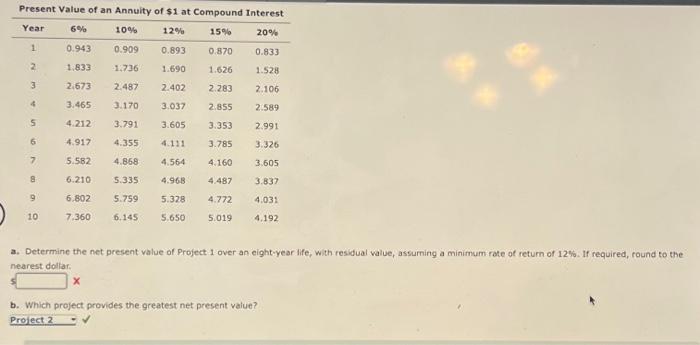

Net Present Value - Unequal Lives Project 1 requires an original imvestment of $125,000. The project will yield cash fiows of $50,000 per yeat for 10 years. Project 2 has a computed net present value of $135,000 over an elight-year life. Project 1 could be sold at the end of eight years for a price of $8,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. a. Determine the net present value of Project 1 over an eight-year life, with residual value, assuming a minimum rote of return of 12%. If required, round to the nearest dollar. 3 x b. Which project provides the greatest net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts