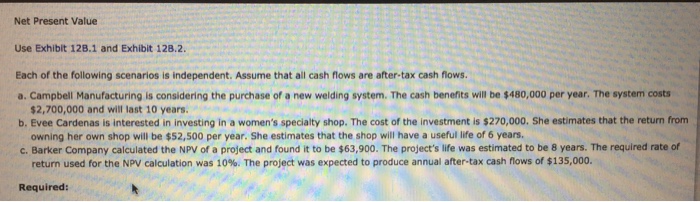

Question: Net Present Value Use Exhibit 128.1 and Exhibit 128.2. Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

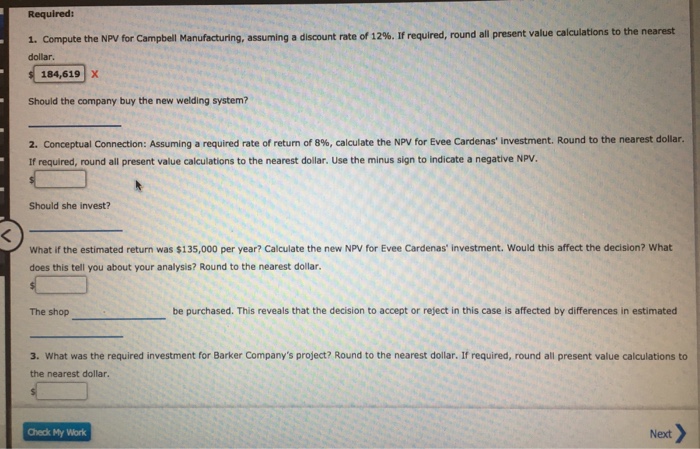

Net Present Value Use Exhibit 128.1 and Exhibit 128.2. Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,700,000 and will last 10 years. owning her own shop will be $52,500 per year. She estimates that the shop will have a useful life of 6 years. return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $270,000. She estimates that the return from c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts