Question: Net present value valuating cash flows with the NI method he net present valve (NPV) rule is considered one of the most common and preferred

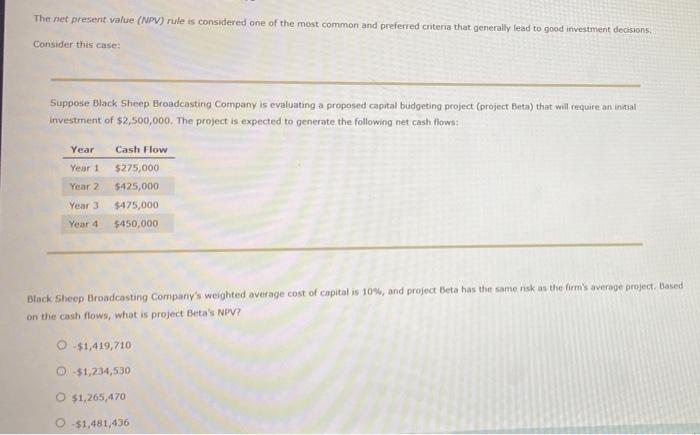

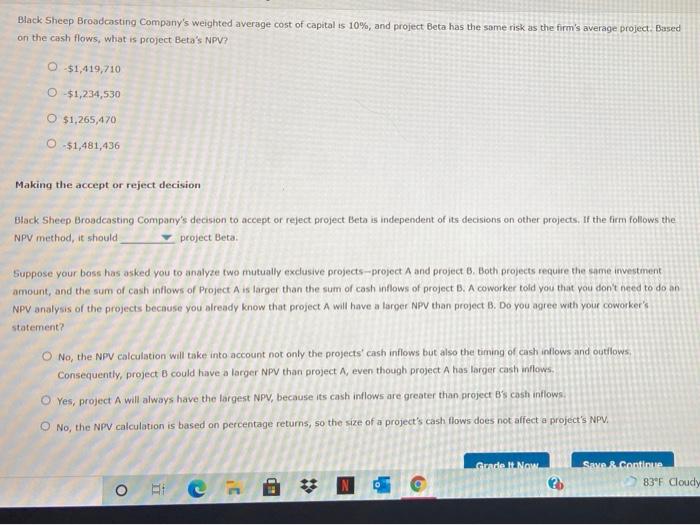

Net present value valuating cash flows with the NI method he net present valve (NPV) rule is considered one of the most common and preferred criteria that generally lead to go Consider this case sapore Black Sheep Broadcasting Company proposed capital detina project project Deta) that anwart of $2.500,000 The project is expected to generate the following net cash flows Year Cash Flow Yeart $275.000 Year 25425.000 Ver $475,000 Yeart 5450.000 Broodonting Company's weighted average cost of capital 10%, and project Beta has the same risks the shflow, what is project Beta NPV? 5110 1,234,530 $1,265,470 O 51A1436 Making the accept or reject decision Block the roadcasting company's decidon to access or rent Brand Beta independent of ts desocon other pa POV method, should project beta . oppose your bost has asked you to analyze two mully diverse and projects. Both projects reg mount, and the sum of Cashows Project Assurger than the sono contestows of projects. A coworker told you Prolysis of the projects because you whenoy brow the projects at have a larger now than project b. Do you are atatert No, the NPV calcolation will take to account not only the provects cash flows but also the timing of combini Consequently, project could traveler NPV tham ct Arve theraph project A tatarger cash flows. o ve project . A will always how the loroest Ney, because its cash indows are greater than project one cash inton No, the NPV calculation is based on percentage eture, so the site of a project's cash flow does not affect as Grade It Now The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions Consider this case: Suppose Black Sheep Broadcasting Company is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $2,500,000. The project is expected to generate the following net cash flows: Year Year! Year 2 Cash Flow $275,000 $425,000 $475,000 $450,000 Year 3 Year 4 Black Sheep Broadcasting Company's weighted average cost of capital is 10%, and project Beta has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NPV? -$1,419,710 0-$1,234,530 O $1,265,470 -$1,481,436 Black Sheep Broadcasting Company's weighted average cost of capital is 10%, and project Beta has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NPV? O $1,419,710 O $1,234,530 O $1,265,470 O $1,481,436 Making the accept or reject decision Black Sheep Broadcasting Company's decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta Suppose your boss has asked you to analyze two mutually excusive projects -- project A and project B. Both projects require the same investment amount, and the sum of cash inflows of Project A is targer than the sum of cash flows of project B. A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project A will have a larger NPV than project B. Do you agree with your coworker's statement? O No, the NPV calculation will take into account not only the projects' cash inflows but also the timing of cash intlows and outllows, Consequently, project could have a larger NPV than project A, even though project A has larger cash flows. Yes, project A will always have the largest NPV, because its cash inflows are greater than project B's cash inflows. No, the NPV calculation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPV. Grade It Now Save & Continue 83F Cloudy 2 o i 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts