Question: Net Present Value-Unequal Lives Bunker Hill Mining Company has two competing proposals: a processing mill and an e investment of $936,474. The net cash flows

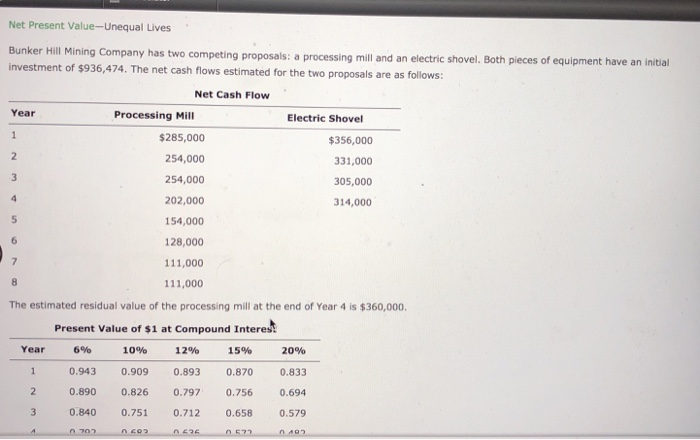

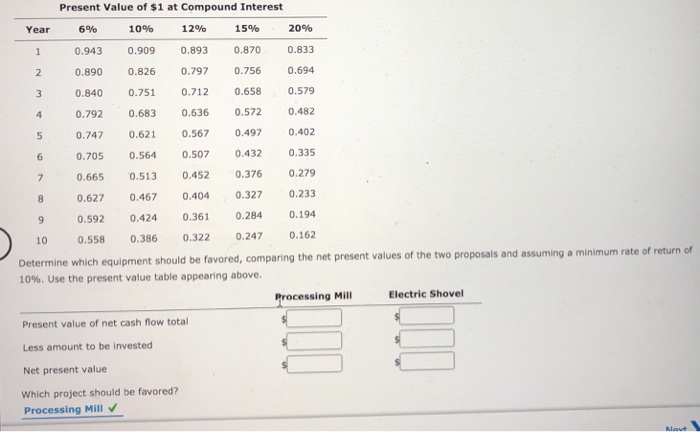

Net Present Value-Unequal Lives Bunker Hill Mining Company has two competing proposals: a processing mill and an e investment of $936,474. The net cash flows estimated for the two proposals are as follows: ectric shovel. Both pieces of equipment have an initial Net Cash Flow Year Processing Mill Electric Shovel $285,000 254,000 254,000 202,000 154,000 128,000 111,000 111,000 356,000 331,000 305,000 314,000 The estimated residual value of the processing mill at the end of Year 4 is $360,00o. Present Value of s1 at compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.8930.870 0.833 2 0.890 0.826 0.7970.756 0.694 3 0.840 0.751 0.712 0.658 0.579

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts